Introduction

Stablecoins have often been viewed as the bridge between traditional finance and the world of crypto. They offer the stability of fiat currency while retaining the advantages of blockchain technology. Among the many uses, staking initially emerged as a promising way to earn passive income. However, it hasn’t achieved the widespread popularity many anticipated, unlike other staking mechanisms. This article explores the historical context behind stablecoin - staking's limited adoption, backed by data, facts, and real-world examples.

New in crypto? Recommending to start with Molecula’s article

The Rise of Stablecoins: A Brief Overview

The Early Promise

The initial excitement around stables staking stemmed from the idea that users could earn yields without exposing themselves to the volatility typical of cryptocurrencies. In their early days, staking protocols like Curve Finance offered yields of 10-20% APY, attracting significant attention from the crypto community. However, these rates were often tied to complex DeFi strategies that carried hidden risks, which became apparent as the market matured.

Key Moments in Stablecoin History

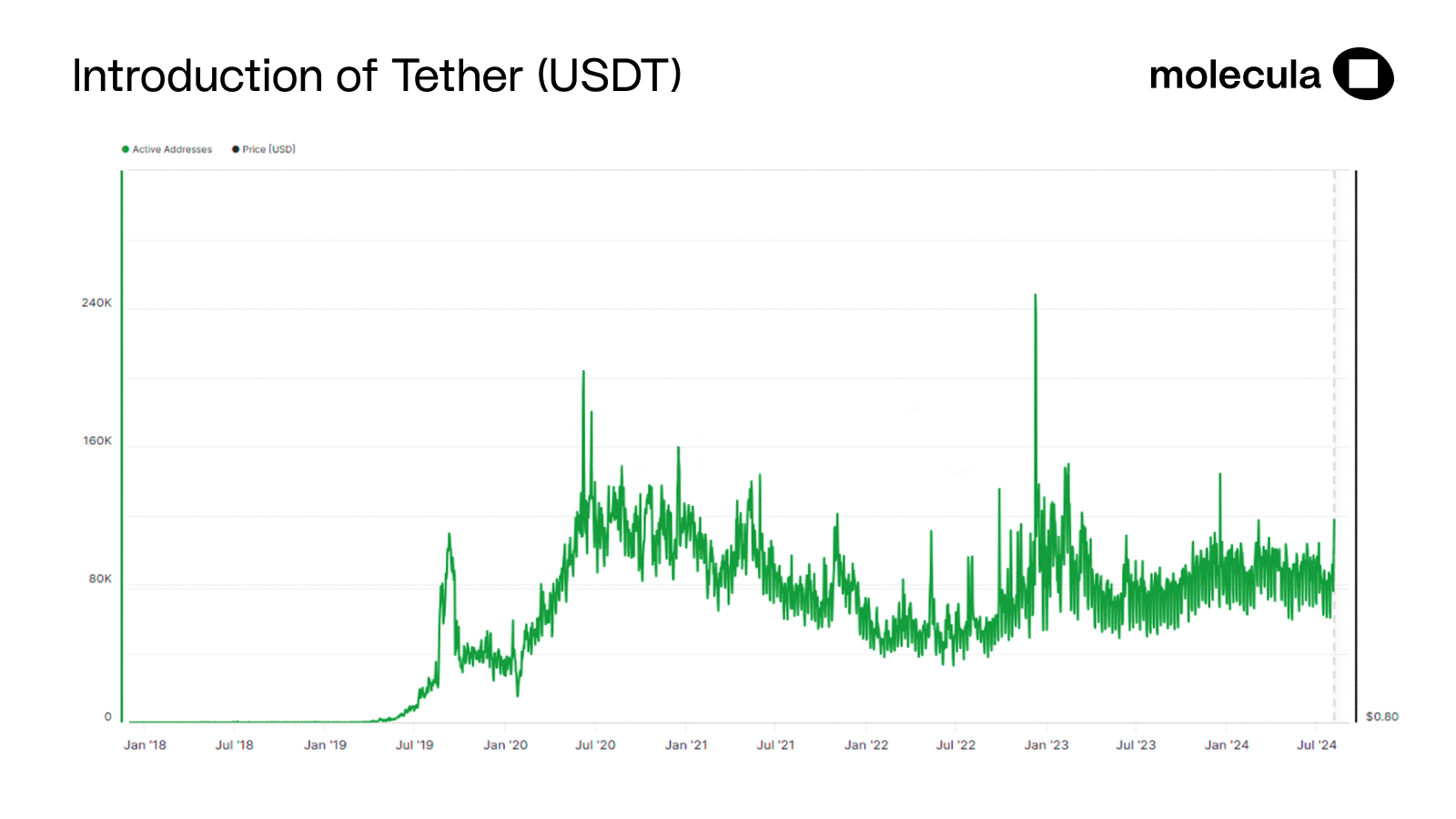

- Introduction of Tether (USDT): Launched in 2014, USDT became the first major stablecoin, and its adoption skyrocketed, becoming the primary liquidity source for many crypto exchanges.

Source: https://t.ly/xMeCZ

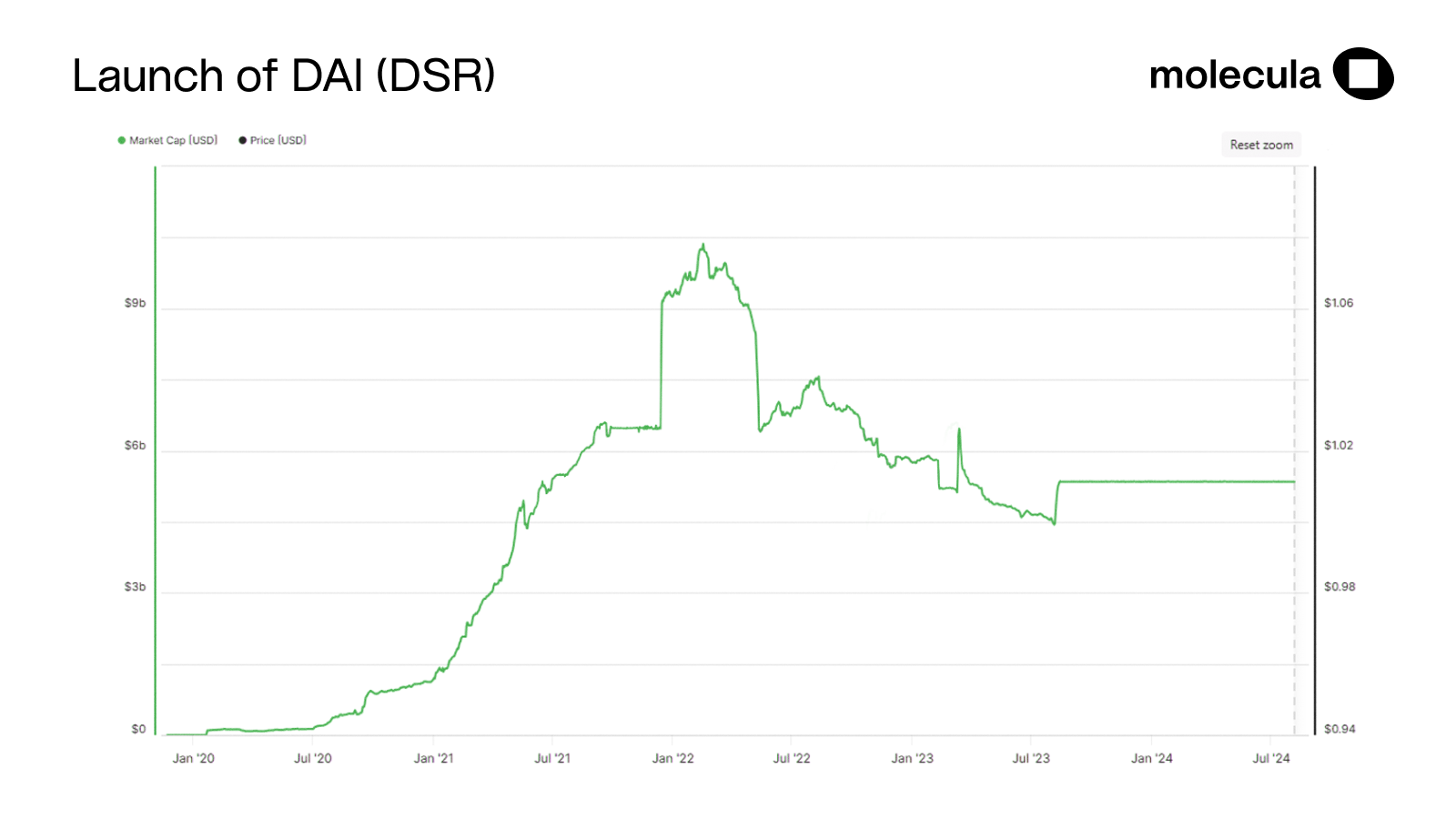

- Launch of DAI (DSR): In 2017, MakerDAO introduced DAI (DSR), a decentralized stablecoin backed by a pool of collateral on the Ethereum blockchain. By 2024, DAI’s market cap reached approximately $5 billion.

Source: https://studio.glassnode.com/metrics?a=DAI&category=&ema=0&m=market.MarketcapUsd&mAvg=0&mMedian=0&s=1573603200&u=1724716800&zoom=

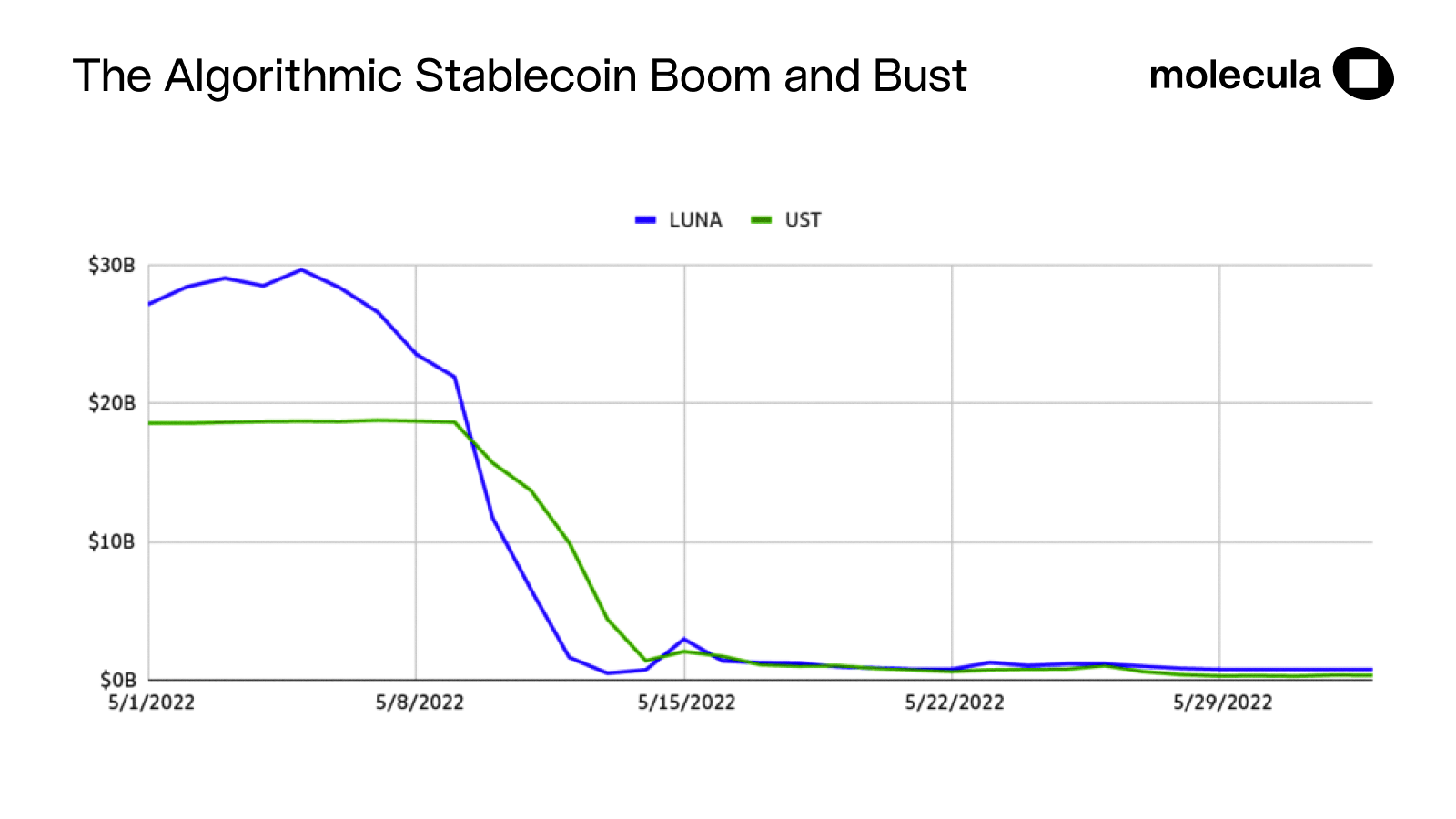

- The Algorithmic Stablecoin Boom and Bust: 2021-2022 saw the rise of TerraUSD (UST), which collapsed in May 2022, wiping out billions in value and highlighting the risks inherent in some models.

Source: https://www.chainalysis.com/blog/how-terrausd-collapsed/

The Concept of Staking in the Crypto World

What is Staking?

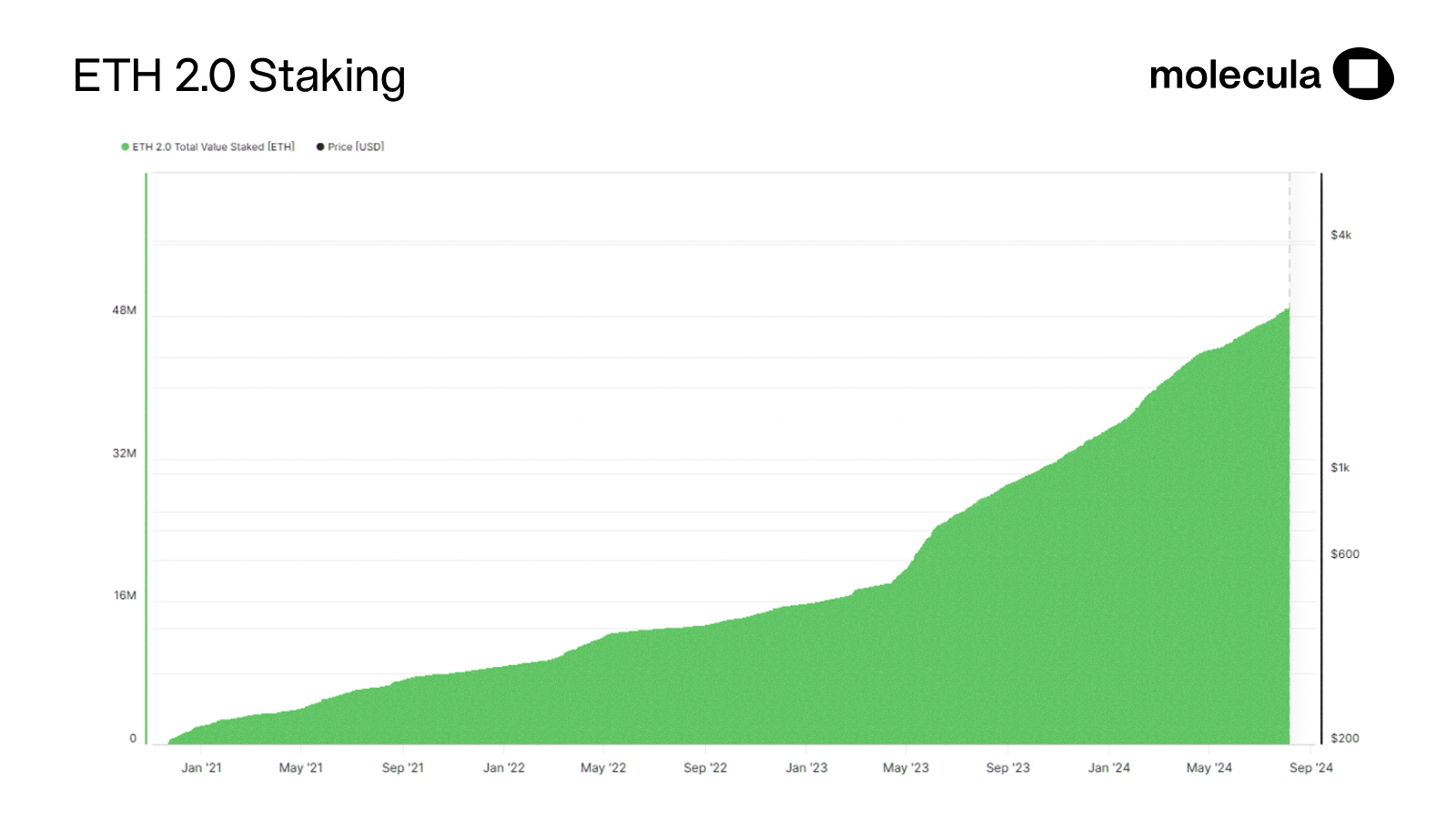

Staking refers to locking up a cryptocurrency to support the operations of a blockchain network, typically a Proof-of-Stake (PoS) network. In return, participants earn rewards, often as additional tokens. As of 2024, over $300 billion worth of crypto assets are staked across various networks, with Ethereum 2.0 alone accounting for over $45 billion.

Source: https://t.ly/435JS

Early Successes in Crypto Staking

Ethereum’s transition to PoS in 2022 was a landmark event, with over 20 million ETH (valued at approximately $36 billion in 2024) staked on the network. This success story fueled staking growth across other networks like Solana and Cardano, each boasting billions in staked assets. The high returns from these networks, often ranging from 4% to 10% APY, created a strong incentive for users to stake their assets.

Staking Mechanisms Explained

They were designed to offer users low-risk interest-earning opportunities. For example, platforms like Anchor Protocol on the Terra network once offered 20% APY on UST staking, attracting billions in deposits before its collapse. Other platforms, like Aave and Compound, provided more conservative rates (2-8% APY) on stablecoin deposits by lending them to borrowers. However, these mechanisms often carried risks, as evidenced by the Terra collapse, where users lost significant portions of their staked funds.

The Hype and Reality: Why Stablecoin Staking Didn't Take Off

High Expectations vs. Reality

The reality didn’t live up to the initial hype. While early platforms promised high returns, the rates often fell as more users joined and market conditions changed. Data from platforms like Curve Finance shows that yields on stablecoin pools dropped from double digits to as low as 1-3% APY as liquidity increased. This decline in returns made the offer less attractive, particularly when compared to other, riskier staking opportunities that offered higher rewards.

Interested in earning with stablecoin USDT? Here’s the article for readers like you

Regulatory Hurdles

Stablecoin staking has also been hampered by regulatory uncertainty. In 2023, the U.S. Securities and Exchange Commission (SEC) warned several stablecoin issuers, leading to increased scrutiny and regulatory crackdowns. For example, in May 2024, the SEC fined a major issuer $10 million for non-compliance with financial regulations, creating a chilling effect on the development of new staking platforms. This regulatory uncertainty discouraged many potential users from participating.

Market Dynamics

Market dynamics played a significant role in the limited adoption of stablecoin staking. In a low-interest-rate environment, the returns were often too modest to attract significant interest. For instance, during the 2022-2023 bear market, interest rates on major platforms like Aave and Compound for USDT and USDC staking dropped below 2% APY. Additionally, the competition from other staking opportunities, such as those offering governance tokens with additional incentives, diverted attention away from stablecoins.

Security Concerns

Security concerns have been a significant deterrent to worldwide adoption. The 2022 collapse of the Terra ecosystem, where over $40 billion in value was wiped out, highlighted the risks associated with algorithmic stablecoins. The DeFi sector has also been plagued by hacks and exploits, with over $3 billion stolen in 2023 alone. These security issues have made users wary of staking their stablecoins, fearing the potential loss of their funds.

Case Studies: Learning from the Past

Case Study 1: The Rise and Fall of Algorithmic Stable

One of the most infamous examples is the collapse of TerraUSD (UST), that was once a darling of the DeFi world. In its heyday, UST offered a 20% APY through the Anchor Protocol, attracting billions of dollars in staked assets. However, in May 2022, UST lost its peg to the dollar, leading to a catastrophic collapse that wiped out over $40 billion in market value within days. This event eroded trust in algo stablecoins and highlighted the systemic risks in DeFi staking mechanisms.

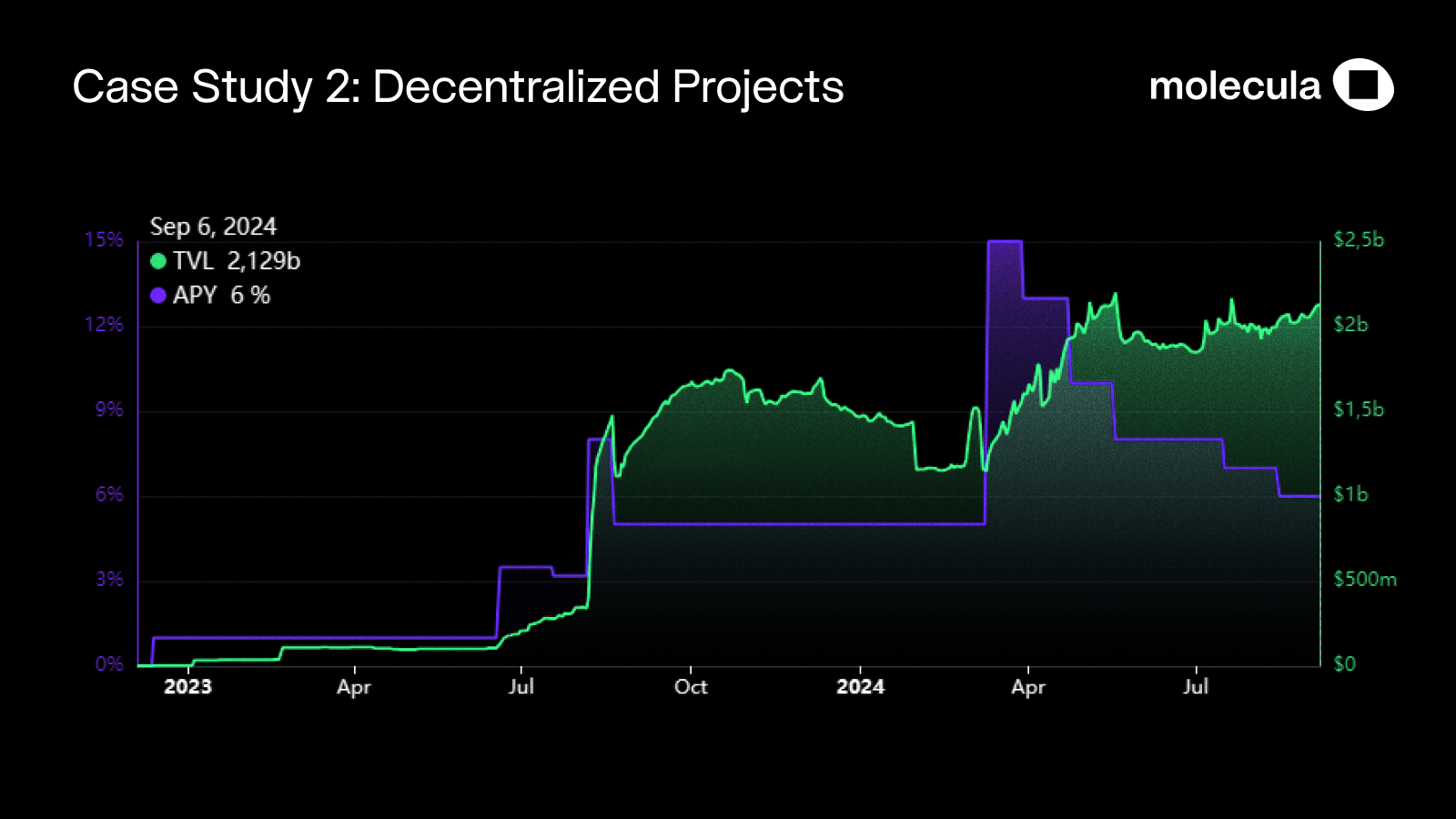

Case Study 2: Decentralized Projects

Another example is the decentralized stablecoin DAI (DSR), backed by collateralized debt positions (CDPs) on the MakerDAO platform. While DAI (DSR) has generally maintained its peg, its staking mechanisms through platforms like Compound and Aave have struggled to attract significant interest due to relatively low yields. For instance, as of mid-2023, the APY for staking DAI (DSR) on Compound was around 1.5%, significantly lower than the yields offered by riskier assets. This case shows that even well-established stablecoins, tied to external assets face challenges in attracting stakers.

Source: https://defillama.com/yields/pool/c8a24fee-ec00-4f38-86c0-9f6daebc4225

Lessons Learned

These case studies underscore the risks and challenges associated with stablecoin staking. The Terra collapse demonstrates the dangers of relying on algorithmic mechanisms without sufficient safeguards. At the same time, the struggles of decentralized projects like DAI (DSR) highlight the need for competitive yields and robust user incentives. Yield-generation platforms must address these issues to regain user trust and achieve broader adoption.

To learn more about USDT safety, check Molecula’s article

The Role of Different Stablecoins in Staking: A Comparative Analysis

The stablecoin ecosystem is diverse, with various options available for staking, each offering unique advantages and challenges. The most prominent are DAI (DSR), USDC, and USDT, which have dominated the market due to their widespread use and established reputation.

- DAI (DSR): As a decentralized stablecoin, DAI (DSR) is backed by a pool of collateralized assets on the Ethereum network. Its staking potential has been explored on platforms like Aave and Compound, where users can earn modest returns. However, its decentralized nature and reliance on volatile collateral have made its staking less attractive than other stablecoins.

- USDC: Issued by Circle, one of the most trusted and known for its regulatory compliance and transparency. USDC staking is popular on centralized platforms and DeFi, offering users a secure way to earn interest. The Circle stablecoin is particularly favored in regions with strict regulatory environments.

- Tether (USDT): Despite controversies surrounding its reserves, the USDT remains the most traded one globally. Its liquidity and widespread adoption make it a staple in the crypto economy. USDT staking, while offering lower yields, benefits from the stablecoin's extensive market integration.

- Algorithmic and Others: Terra stablecoin (UST) and its counterpart, Luna, gained attention before their collapse, highlighting the risks of algorithmic stables. Meanwhile, new entrants like Ethena and Cardano are exploring innovative staking models, though they remain experimental. As the market evolves, these two cryptocurrencies may offer new opportunities for staking, provided they can overcome the challenges their predecessors face.

This comparative analysis of different stablecoins highlights the varying degrees of risk and reward in the yield generation landscape, offering insights into which assets might be more appealing for different investor profiles.

The Future: Challenges and Opportunities

Current Trends

Despite past challenges, stablecoin staking is evolving. For example, in late 2023, Aave introduced a new mechanism that offers higher yields by integrating with its liquidity pool ecosystem. This innovation and the growing interest in stablecoin payments for international remittances (estimated at $6 billion annually) suggest that yield generation for stables could see renewed interest if platforms can offer competitive returns while mitigating risks.

Potential for Growth

The potential for growth in a field lies in regulatory clarity and technological innovation. For instance, the European Union’s Markets in Crypto-Assets (MiCA) regulation, set to be fully implemented by 2024, provides a clear framework for stablecoin issuers, potentially reducing regulatory uncertainty. Additionally, advancements in decentralized finance (DeFi), such as developing more resilient algorithmic stablecoins and improved security protocols, could make it even more attractive to a broader audience.

What Needs to Change

Several changes are needed:

- Regulatory Clarity: Clear regulatory frameworks, like MiCA in the EU, will help reduce uncertainty and encourage more platforms to offer such services.

- Improved Security Measures: Enhancing security through better smart contract audits, insurance protocols, and robust governance will help rebuild trust in this method.

- User-Friendly Platforms: Simplifying the user experience, such as by integrating staking directly into popular wallets or exchanges, will make it easier for users to participate without navigating complex DeFi ecosystems.

- Competitive Interest Rates: Platforms to offer more competitive rates by combining staking with other financial services like lending or liquidity provision. For example, Aave’s new staking model, which offers higher returns by leveraging its liquidity pools, is a step in the right direction.