What marks the beginning of mass adoption in civilization? It begins when people start getting paid with specific goods, currency, or coins. This has happened with gold, Venetian ducats, and several other forms of currency throughout history. What about crypto? Are there many enthusiasts eager to earn USDT instead of traditional euros or dollars? And what do they do with it afterward? Let’s explore this topic and try to set it up.

How to Earn USDT

The share of Web3 jobs in the global job market grows significantly year over year. To compare, here’s a chart on the number of mobile apps describing themselves as Web3 applications. Most of these apps pay salaries in USDT, enabling contractors to earn USDT daily.

Distribution of mobile apps describing themselves as Web3 apps as of May 2022, by category

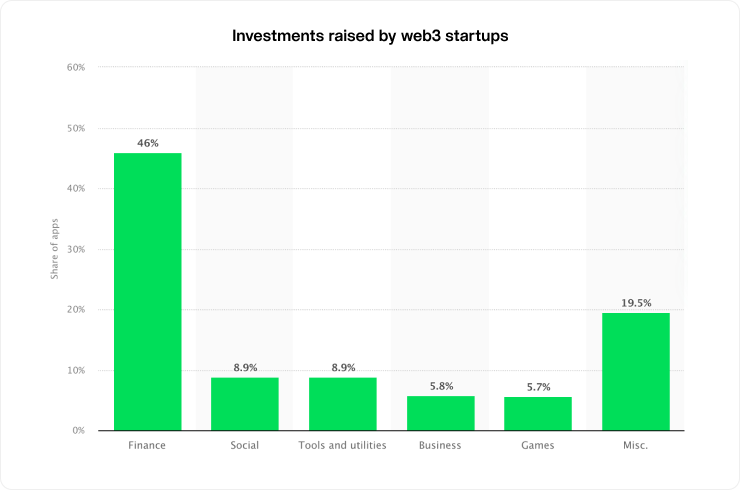

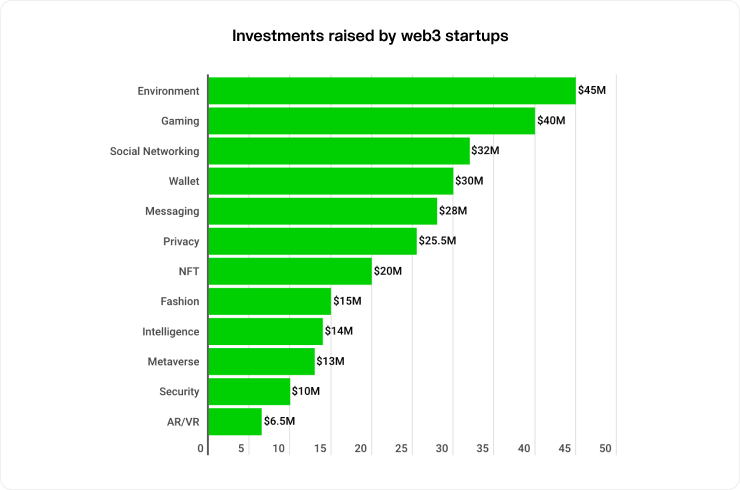

Here are some additional statistics regarding the Web3 market:

- 108 Web3 startups attracted approximately $814 million worth of investment during the first quarter of 2023.

- The statistics are encouraging as they imply a transition from the old Web2 strategy to a more modern approach to dealing with online users. Additionally, the large amount of money invested suggests that investors believe Web3 can provide a return on investment.

Investments raised by web3 startups during the first quarter of 2023

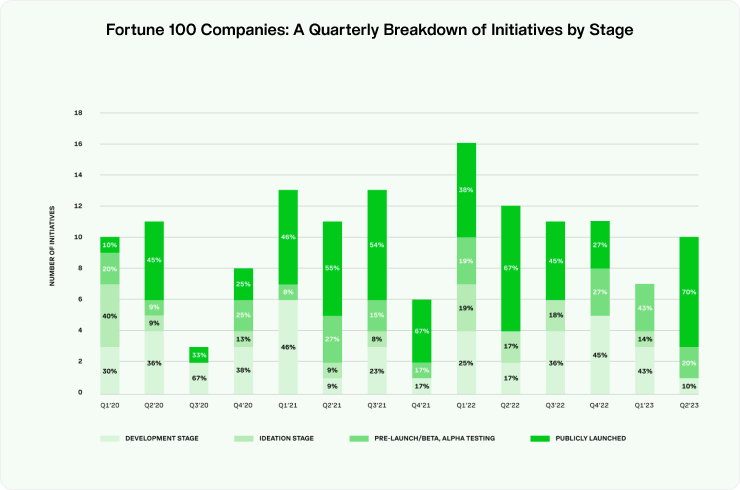

- 52% of Fortune 100 companies have embraced Web3 since the start of 2020. Since January 2022, approximately 60% of initiatives taken up by Fortune 100 companies are in the pre-launch or launched phases. These companies recognize the need for a revolutionary change in the global finance system, and Web3 with blockchain is just the solution.

Fortune 100 Companies: A Quarterly Breakdown of Initiatives by Stage

Thus, engaging in Web3, or freelancing for Web3, helps you earn USDT online and leverage career opportunities. The Web3 world integrates experts from various backgrounds, helping them maximize their skills and achieve new goals. It's not only for Blockchain Developers or Smart Contracts Developers—crypto is open to Analysts, Marketers, Product Managers, and Customer Support experts. Check different job boards for job requirements and salaries offered. Due to the lack of experts in the market, some companies are establishing their own academies, making it easier to enter Web3.

Real-world companies are also in the process of adopting Web3. The top 10 Fortune 100 brands in volume of Web3 initiatives are:

- IBM (18)

- Alphabet (11)

- Microsoft (11)

- Goldman Sachs (10)

- JP Morgan Chase (9)

- Amazon (6)

- Citigroup (6)

- Coca-Cola (5)

- Nike (5)

- Bank of America (5)

How to Earn With USDT TRC20

In simplest terms, Tether stablecoin, also known as USDT, is a digital coin representing cash because its Dollar backing minimizes price fluctuations. Crypto enthusiasts tend to prefer USDT to mitigate the volatility risks seen in cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

So, you’ve acquired your share of USDT and are looking for ways to make fast bucks directly from your holding. However, since USDT is priced according to the US dollar with little fluctuation, there is only so much you can earn with this currency.

Let’s explore several means of making profits using USDT, specifically from the Tron blockchain (USDT TRC20). But first, let's discuss what makes TRC20 the leading USDT investment option network compared to its competitors.

Why Invest in USDT TRC20?

USDT operates on multiple blockchain networks, each with distinctive features and benefits, and among these is the TRC20 protocol on the TRON blockchain.

USDT is based on several different blockchain networks, one of which is the TRC20 protocol. For crypto users and investors alike, the TRC20 protocol has established its niche among other blockchain networks like Ethereum, Solana, Avalanche, or Polygon.

TRON’s USDT TRC20 serves users in a much more efficient way than the competition for the following reasons:

Low Transaction Fees

Transactions on the TRON network usually attract lower fees than other leading networks, making USDT transfers more economically efficient compared to networks like Ethereum (ERC20) or Bitcoin's Omni Layer. For example, at low network activity, a 100 USDT transaction on Ethereum can cost about $4 to $6 in ETH, whereas a transaction on TRON of similar value can cost half of that, even less at times.

Timely Transactions

Another key feature where USDT TRC20 really proves itself is transaction time. The TRON blockchain is faster than Ethereum in terms of block process, meaning you’ll experience much quicker transaction times than you would on Ethereum. This is essential for traders transferring fiat capital to get into trading positions, who need to get it in the market quickly and capitalize on a trading opportunity.

Network Congestion Issues

Blockchain networks like Ethereum can suffer from congestion, leading to slower transaction times and higher fees, especially during peak periods. The TRON network, by contrast, is optimized for high throughput, which reduces the likelihood of congestion and maintains low transaction costs and speeds, even during high-demand times.

Maximizing Your USDT TRC20 Profits

Crypto assets like Bitcoin or Dogecoin mainly yield profits based on price fluctuations, a luxury that stablecoin investors don’t have. If you are holding some USDT in your wallet, you might feel the best option is to hold or swap it for a more volatile crypto to reap profits.

However, despite how unchanging USDT seems in terms of value, there are several ways you can take your assets into account to earn income directly. Just like in any other form of investment, you can either gain a lot or lose it all. No amount of expert opinion will guarantee you profits, so before taking any approach, it’s highly advisable to do your own research (DYOR).

Here are some viable ways to earn USDT:

Lending Platforms

For those considering how to earn USDT daily, lending platforms could offer a viable option. These networks provide USDT earn income as high as 30% APY. Lending is a popular investment strategy for newbie crypto investors, who usually hold less than $500 in USDT but don’t know exactly where to put their money.

Examples of the most popular lending networks include Wirex, Nexo, and Yield App. These platforms work quite similarly to those dealing with traditional currency; you choose a platform, send your tokens to it, and earn USDT from interest. Sounds simple, right?

Sadly, it does need a more careful approach than simply making transfers and waiting for profits passively. There are some challenges that come with the promise of passive income from lending your crypto:

- Fluctuating interest rates: The interest rates on these platforms can change quickly due to market conditions. What may seem like a high rate today could drop significantly tomorrow.

- Potential security risks: There are security and stability risks associated with using these platforms. Since they operate online, there is always a chance of hacking or other cyber threats. Additionally, the platform itself may face financial difficulties or regulatory issues.

- Needs continuous monitoring: To protect their investments, investors need to constantly monitor the platform and stay updated on any changes or developments. The strategy requires time and effort, which may not be feasible for everyone.

While platforms lending USDT can offer attractive returns, it's important for investors to carefully consider the above factors before committing their funds.

Yield Farming

Yield farming is also quite popular, given its promise of high profits. However, it is notoriously complex, making it difficult for most people to navigate.

Yield farming refers to depositing your USDT tokens into a decentralized finance protocol (DeFi) liquidity pool, which generates rewards for you. There are two main types of liquidity pools: lending and trading. On both platforms, you, as a liquidity provider (LP), will earn USDT profits in annual percentage yields for providing liquidity.

APYs in yield farming could go as high as 30%, although there’s a small catch. As an investor, you have to deal with complex liquidity pools with a significant risk of impermanent loss.

Impermanent loss happens when the value of the assets you deposit changes compared to when you first deposited them, which is very common in crypto. Such a loss could put you at a disadvantage if you decide to withdraw your funds later.

Yield farming requires constant monitoring and a deep understanding of how different pools work. It's not something that can be done passively or without prior knowledge.

Owing to the risks and complexities of yield farming, Molecula is ready to help you circumnavigate all these issues. Our platform enables you to leverage USDT with up to 17% APY in returns, with no need to bridge or stake your tokens. Molecula assures you of maximum returns, and you’ll earn USDT yields daily.

Trading USDT

Lastly, there is the option of trading USDT TRC20, which follows a simple yet effective strategy: buying when prices are low and selling when they are high. The strategy may work effectively when selling it for other fiat currencies or other cryptocurrencies. However, it will require you to keep monitoring price changes.

It's important to note that although this approach may seem easy, it requires extensive knowledge of the market and constant monitoring of its fluctuations.

Cryptocurrency price changes are highly unpredictable, which means that while there is a chance for significant profits, there is also a huge risk of losing money.

The Molecula Dream: Helping You Make the Most of Your USDT

-1600x900.png)

It is a general sentiment among crypto investors that earning profits directly with USDT is challenging, so millions of stablecoin investors hold them, wondering where to go next. However, our team certainly believes most are missing out on huge investment opportunities, so we created Molecula.

Molecula is an upcoming investment solution ready to bring out the potential of stablecoin investments, an all-in-one platform and at the touch of a button. We also aim to go beyond just earning by offering exclusive rewards Molecula’s points.