Outcomes At the Whole Beginning for the Busiest Readers

Stablecoins bridge the gap between the crypto world and traditional finance. With stables, investors get additional yield (Molecula helps here) while also being able to hold crypto assets. While traditional cryptos experience constant large price swings, stablecoins emerge as a safe alternative to maintain flexibility. They are widely used within crypto exchanges and enable users to quickly exchange them into other cryptos for very low fees.

Further, we’ll explain why stablecoins are not only a crypto exchange method, how stables gained so much popularity globally, and why they are crucial for the crypto ecosystem.

What is a Stablecoin?

There are several signs of mass adoption of crypto, and attentive readers can find mentions of stablecoins in authoritative sources like the Bank of England, or others. They also contain stablecoin definition, like:

“Stablecoins are a form of digital asset that can be used to make payments. They tend to be less volatile than cryptoassets. That is because their value is tied to other, stable, assets. “

Stablecoin's meaning is simple: It always equals its pegged fiat currency 1 on 1, enabling holders to maintain the value of their investments. For example, 1 USDT always equals 1 USD as it is pegged to the dollar.

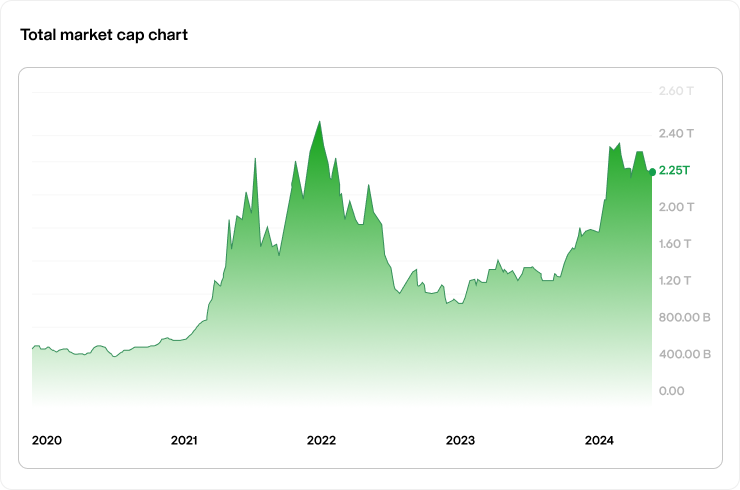

Stablecoins play a crucial role in a crypto ecosystem. While traditional cryptos can change prices in mere minutes, leaving investors no time to breathe between fluctuations, stablecoins maintain their pegged price to fiat currencies. From $2.25 trillion in total market capitalization of cryptocurrencies (July 2024), stablecoins account for around $162 billion (~$0.16 trillion), which equals ~7.2% and is a serious number.

Stablecoins can be used in many ways, including daily transactions, making them super flexible for daily life. This unique characteristic of price stability enables stablecoin holders to get exposure to cryptos while being able to conduct usual transactions such as online payments, receiving salaries, etc.

-740x490.png)

Stablecoins in total crypto markets, top five stable coins by market capitalization.

Stablecoins Explained

Stablecoins are a type of cryptocurrency specifically designed to maintain a stable value, offering a sense of stability in a volatile crypto world. They are typically pegged to fiat currencies, including the dollar, and maintain their price very strictly even in highly volatile markets. While other cryptos, like Bitcoin and Ethereum, can change several tens of percentages on a daily basis, stablecoins are always equal to 1 dollar.

Stablecoins advantages:

- Stablecoins are accepted within every crypto exchange and allow users to maintain exchange operations for low fees in seconds.

- When markets become very volatile, crypto investors typically convert their cryptos into stablecoins to save their capital and wait for a better time to exchange back to other favorites.

- With stablecoins, users can ensure their balance is protected from price fluctuations, which can be very critical, especially during bear markets.

How Do Stablecoins Stay Stable?

As we already determined, stablecoin is a type of cryptocurrency that doesn’t bounce up and down like a crazy rollercoaster ride. But how do they keep their cool?

1. Collateralized Stablecoins: The Safe Bet

Imagine you have a friend named Alex who wants to start a lemonade stand but needs some cash to get going. You lend Alex $10, but Alex wants to make sure you know your money is safe. So, Alex gives you his $10 game card as a guarantee. If the lemonade stand doesn’t work out, you can use the game card. That’s collateral.

Now, let’s bring this back to stablecoins. Some stablecoins are like Alex’s lemonade stand. They’re backed by real-world assets like US dollars, euros, or even gold. For every stablecoin issued, there’s a dollar (or other asset) sitting safely in a bank somewhere. If you ever want to cash out your stablecoin, the issuer gives you the equivalent value in dollars. It’s like having a safety net that keeps the stablecoin’s value steady.

Not so fun and fancy explanation:

- Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by traditional currencies like USD. The most popular stablecoin example is a fiat-backed USDT (Tether), which has a market cap of over 100 billion dollars. USDT is widely popular among crypto communities and is supported by all major crypto exchanges and decentralized exchanges (DEXes). The second most popular stablecoin is USDC, which is also pegged to the US dollar.

- Commodity-Collateralized Stablecoins

These stablecoins are pegged to physical commodities like gold, silver, or oil. These assets are stored in vaults, and stablecoins can be exchanged for these commodities. The most popular example of a commodity-collateralized stable coin is PAX Gold (PAX), which represents one fine troy ounce of gold. PAX allows crypto enthusiasts to hold crypto and gain exposure to gold without the need to physically store and secure the metal, which can be very flexible.

2. Crypto-Collateralized Stablecoins: Double the Fun

What if Alex didn’t have a game card but instead gave you two tickets to the latest blockbuster movie worth $20? That’s over-collateralization—giving more value than needed to ensure safety.

In the crypto world, some stablecoins are backed by other cryptocurrencies like Ethereum. But since crypto can be volatile (like a movie’s box office earnings), these stablecoins are over-collateralized. For example, for every $1 of stablecoin, there might be $2 worth of Ethereum locked up. This extra cushion helps keep the stablecoin stable even if the price of Ethereum drops a bit.

Not so fun and fancy explanation:

Crypto-collateralized stablecoins are typically collateralized by widely adopted and highly reputable cryptos such as BTC, ETH, and others. The most popular and successful stablecoin example of this type is Dai. Dai is backed by a diversified pool of different cryptos held in smart contracts on the Ethereum blockchain. To issue Dai, users have to lock up a larger value of crypto as collateral, which is used as a buffer against price fluctuations.

3. Algorithmic Stablecoins: The Smart Tech

Alright, here’s where it gets really interesting. Imagine Alex’s lemonade stand has a super-smart assistant named Algo. Algo keeps an eye on the lemonade prices and adjusts them based on demand. If there’s a rush and lemonade prices soar, Algo makes more lemonade to bring the price down. If prices drop, Algo slows down production to keep things balanced.

Algorithmic stablecoins work similarly. They don’t rely on any real-world assets but instead use clever algorithms to control the supply of the stablecoin. If the price starts to go up, the algorithm issues more stablecoins to bring the price back down. If the price drops, the algorithm buys back some stablecoins to reduce the supply and push the price back up. It’s like having a super-smart assistant that keeps the value steady without any physical backing.

Not so fun and fancy explanation:

Algorithmic stablecoins are illegal in many jurisdictions after the notorious case of TerraUSD (UST) collapse. UST maintained its peg through a system of supply and demand adjustments and was linked with the issuance and burning mechanism of Luna (another cryptocurrency from the same ecosystem). Many users exploited this weak point and forced the UST and Luna to get into a death spiral where billions of dollars in value evaporated in a matter of days.

Pros and Cons of Stablecoins: Two Sides of the Moon

Okay, let’s jump to the pros and cons. Together with stability and flexibility, stablecoins come with issues of their own.

Pros of stablecoins

- Price stability and reduced volatility: stablecoins maintain their value allowing investors to avoid wild price fluctuations

- Easy integration with financial systems: stablecoins can be integrated into both traditional and decentralized financial systems. They are welcome throughout all decentralized exchanges and all over the world

- Low transaction costs: transaction costs are typically super low with stablecoins, cheaper than traditional bank transfers

- Accessibility and flexibility: stablecoins are widely used globally to store and transfer value without worrying about price fluctuations

Cons of stablecoins

- Centralization risks: stablecoins are mainly issued by central entities meaning users have to trust these entities

- Regulatory uncertainty: current regulatory framework around cryptos is not certain, with new EU MiCA stablecoin regulations there have been rising risks with USDT

- Limited investment growth potential: Stablecoins maintain stable prices and investors can not become extremely rich by investing and holding these coins

- Technological risks: smart contract vulnerabilities and hacks have been an issue for stablecoins development for a long time, and hackers have been stealing billions of dollars

- Dependence on collateral: the value of stablecoins is heavily dependent on the backed assets, if collateral assets are mishandled, stablecoins can lose their peg

The Importance of Stablecoins in the Crypto Ecosystem

Stablecoins are crucial for the crypto ecosystem and regulators around the globe are starting to encourage the use of stablecoins and protecting investors at the same time. The best example could be the MiCA regulations introduced by the EU. These regulations ensure stablecoin issuers are registered entities and are compliant with the standards. This has also caused a challenge for USDT as all the exchanges are forced to follow MiCA regulations to support USDT and Tether will have to register in the EU to ensure it maintains the EU market. Despite these minor challenges, stablecoins are crucial for offering stability during highly volatile markets which is a frequent occurrence in crypto markets.

Asia

In Asia, stablecoins have seen rapid adoption, especially in countries with unstable local currencies. They are widely used in remittances and as a hedge against inflation. Asia is expected to continue growing in stablecoin usage, with a main focus on integration into everyday financial transactions.

America

In America, stable coins like USDT and USDC are widely used for trading and DeFi apps. In 2022, trillions of dollars in value were settled using stablecoins. This widespread adoption shows the important role of stablecoins in providing liquidity and stability within the crypto ecosystem. Despite the USA’s strict regulatory environment, stablecoins are still very popular among investors. USDT led the rising of trading volume in stable coin trading, reaching a quarterly average of 2.96 trillion dollars, which is almost equal to the US equities on the NYSE (New York Stock Exchange, 3.12 trillion dollars).

Europe

Europe’s Markets in Crypto Assets (MiCA) regulations have recognized the importance of stablecoins and encouraged their use while ensuring investor protection and market integrity. The market capitalization of stablecoins increased from 23 billion dollars in 2021 to just under 150 billion in 2022 over the EU.

Overall, stablecoins are here to stay and play an even more important role in a global crypto ecosystem.