When it comes to investing in stablecoins, one question frequently arises: is USDT safe?

Understanding the safety of USDT (Tether) is crucial for anyone looking to invest in this popular stablecoin. This article delves into the security aspects of USDT, comparing it with other stablecoins, and exploring whether USDT is a good investment. Also, we’ve been researching on some experts’ opinion on Tether’s safety and security as the investment.

What is USDT?

USDT, or Tether, is a stablecoin pegged to the value of the US dollar. This means that each USDT token is backed by an equivalent amount of US dollars held in reserve. The primary goal of USDT is to provide a stable alternative to volatile cryptocurrencies like Bitcoin and Ethereum, making it a popular choice for traders and investors seeking stability.

You can read Molecula's article on USDT meaning

Is Tether Safe?

Tether has faced scrutiny and controversy over the years, particularly regarding the transparency of its reserves. Critics have questioned whether Tether holds enough US dollars to back all the USDT tokens in circulation. However, Tether has made efforts to address these concerns by publishing regular attestations of its reserves. These transparency measures have improved over time, enhancing investor confidence.

Statistics and Infographics

To provide a clearer picture of USDT's safety and usage, let's look at some statistics and infographics:

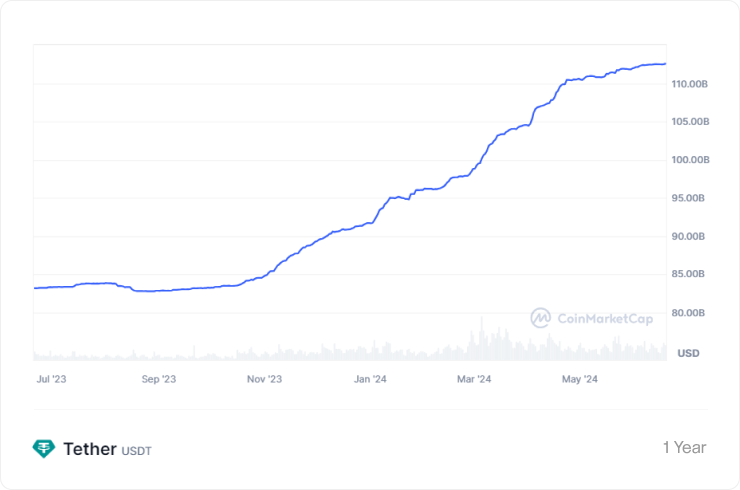

Market Cap: As of June 2024, USDT's market capitalization stands at over $112 billion, making it the largest stablecoin by market cap.

USDT market capitalization - June `24

Trading Volume: USDT consistently ranks as one of the top cryptocurrencies by daily trading volume, often exceeding $100 billion.

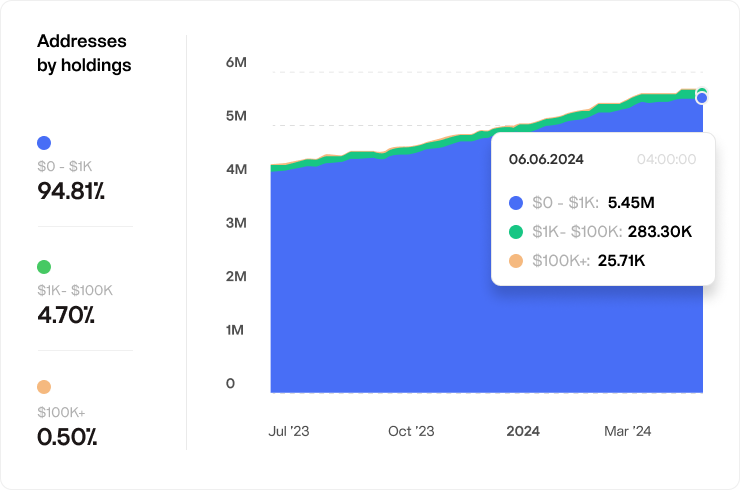

Addresses by holdings: most of USDT holders store less 1K USDT in their wallets.

USDT Security: Addresses by holdings

Speaking on adoption, Tether CEO Paolo Ardoino said, "In the last few years we have seen the usage of USDT going from pure cryptocurrency trading to being basically the most used digital dollar in the world. Almost the entire user base is (in) emerging markets". Ardoino mentioned Turkey, Vietnam, Brazil, Argentina and "African countries", where dollars can sometimes be in short supply.

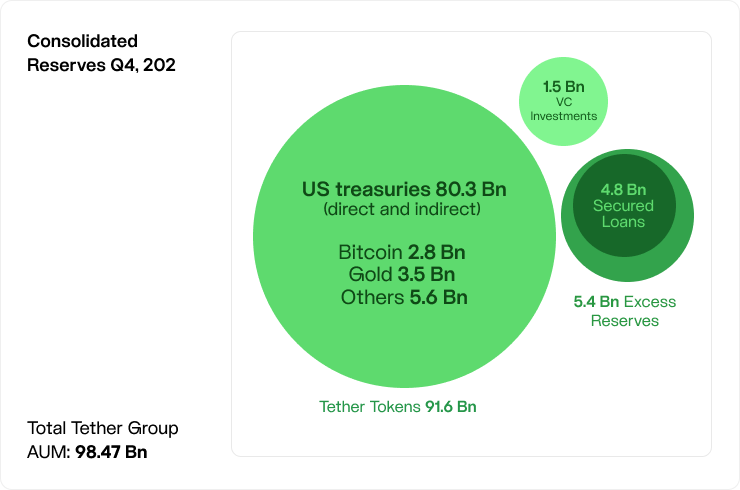

Also, once a quarter, tether.io provides a number of stats secured by a reputable auditors from the BDO auditors’ team, so let’s take a look at them.

The chart below shows that, as of 31 December 2023, Tether accumulated $5.4 billion in excess reserves, fully covering the outstanding ~$4.8 billion in secured loans included in the USD₮ reserves.

Total Tether Group AUM as of 12/31/2023

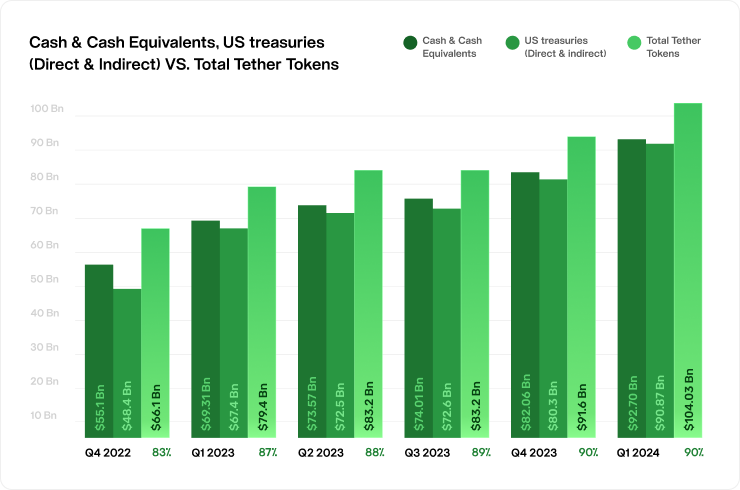

The chart below shows the growth of US Treasuries and Cash and Cash Equivalent versus total outstanding Tether Tokens.

Cash and Cash Equivalents, US Treasuries VS. Total Tether Tokens. USDT Security

It's crucial to conduct your own research before making any investment, including stablecoins. Despite their perceived stability, risks and market changes can still impact their value. Staying informed ensures you make well-rounded decisions and protect your investments. Always prioritize due diligence for financial security.

Is Holding USDT Safe?

Holding USDT can be considered relatively safe compared to other cryptocurrencies due to its stable value. However, it is essential to store USDT in a secure wallet to prevent theft or hacking. Using reputable exchanges and wallets with robust security measures can further enhance the safety of buying and holding USDT.

Is USDT a Good Investment?

Investing in USDT can be a strategic choice for those looking to mitigate risk in the volatile cryptocurrency market. USDT offers a stable store of value, making it useful for preserving capital during market downturns. However, as with any investment, it is crucial to conduct thorough research and consider your risk tolerance. You can read more on the regulatory status of stablecoins in media and blogs.

USDT's stability and liquidity make it a valuable asset for traders and investors. It allows for quick and efficient transfers between exchanges, reducing the risk associated with holding volatile cryptocurrencies. However, potential investors should be aware of the ongoing debates surrounding Tether's reserves and regulatory status.

Expert Opinions

When evaluating the safety of USDT (Tether), it's important to consider various expert opinions and market trends. Ruslan Lienkha, Chief of Markets at YouHodler, highlights that "USDT is an offshore stablecoin with a lack of transparency and regulation, while USDC is closely watched by U.S. authorities." This distinction underscores a significant risk associated with USDT: its offshore status and the relative opacity of its operations. The lack of stringent regulatory oversight could potentially expose USDT holders to unforeseen risks compared to more regulated stablecoins like USDC.

Chayanika Deka, a financial journalist, points out that "Despite holding onto the top spot, Tether is gradually losing its market share due to increasing competition from regulated alternatives like USDC." This shift indicates a growing preference among users for stablecoins that offer more transparency and regulatory compliance. As the market evolves, this trend could erode USDT's dominance, pushing users towards options perceived as safer and more reliable.

In summary, while USDT remains a popular and widely used stablecoin, its safety is increasingly questioned due to regulatory concerns and market competition. Users and investors should weigh these factors carefully, considering the potential risks and benefits when choosing a stablecoin for their needs.

Conclusion

In conclusion, the question "is USDT safe" does not have a straightforward answer. While USDT offers stability and liquidity, it is not without risks. Investors should weigh the benefits of using USDT against the potential uncertainties surrounding Tether's reserves and regulatory environment. By staying informed and using secure storage methods, like cold wallets, investors can make more confident decisions about holding and investing in USDT.