Introduction

For well-informed investors seeking to merge traditional, conservative investment strategies with crypto, Crypto ETFs (Exchange-Traded Funds) offer an intriguing opportunity. This article explores Crypto ETF meaning, importance, recent market developments, and how they can fit into a balanced investment portfolio.

What is an ETF?

Definition of Exchange-Traded Funds (ETFs)

Imagine wanting a slice of a financial market without diving into each asset in that market. That's where ETFs come in handy. An ETF is a financial product that tracks the performance of a group of assets, like a specific stock index, a sector (like tech or healthcare), a commodity (such as gold), or even a specific asset class. It’s like having a basket containing a bit of everything you’re interested in, allowing you to invest broadly without picking individual stocks, bonds, or commodities.

So, when you buy shares in an ETF, you’re buying a slice of all the assets it tracks and can trade them on the stock exchange just like you would with individual stocks. This means ETFs offer the benefits of diversification and ease of stock-like trading.

How ETFs Work in Traditional Finance

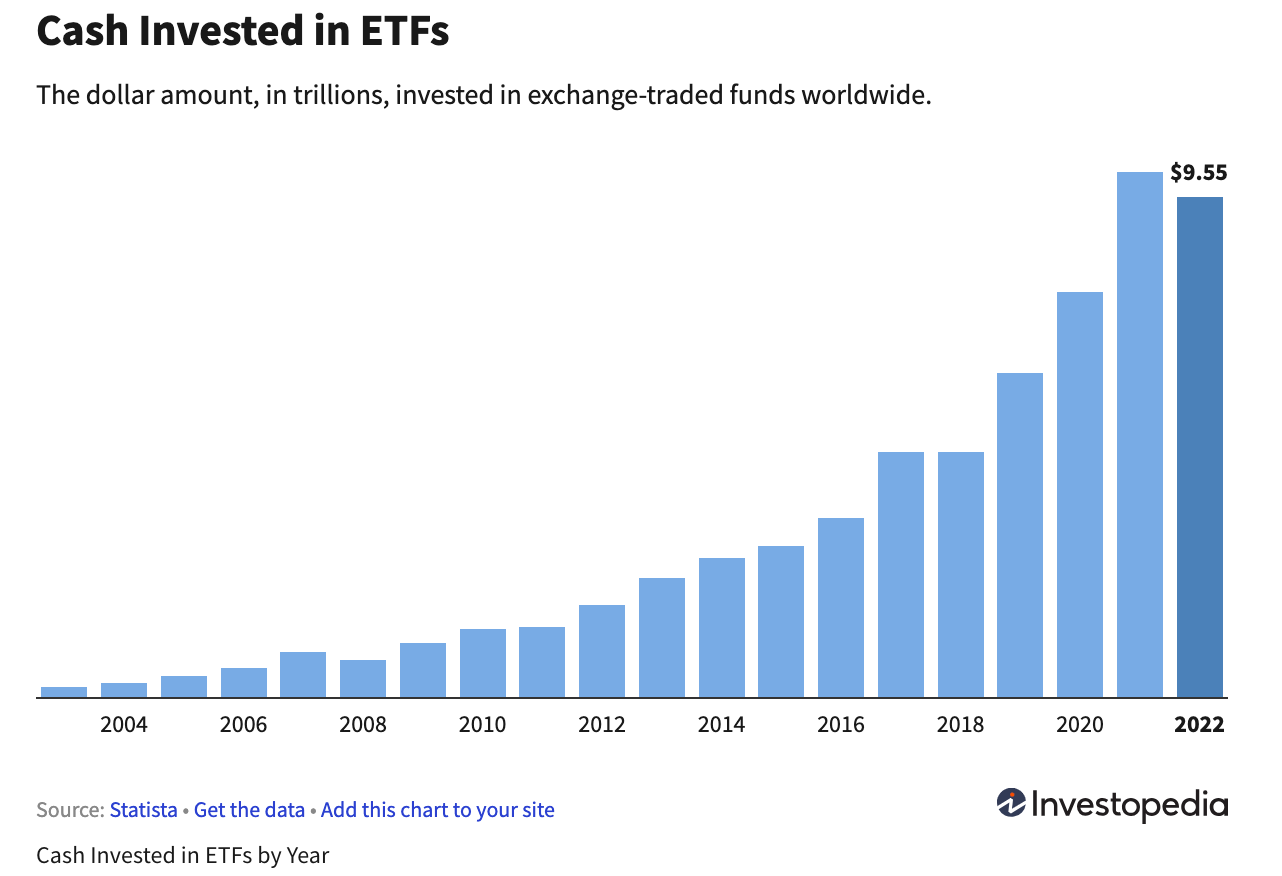

ETFs are popular among traditional investors; they simplify building a diversified portfolio. Imagine buying small portions of stock in the S&P 500 to spread risk—it’s tedious and would come with hefty transaction fees. ETFs solve this by pooling money from many investors, allowing everyone to own a small piece of the whole bunch without the hassle of individual transactions.

Additionally, unlike mutual funds that settle at the end of the day, ETFs can be traded at market prices throughout the day, giving investors more control. This flexibility is why ETFs are the go-to for individual and institutional investors.

Benefits of Investing in ETFs

So, why are ETFs attractive to investors? They come with built-in perks:

- Diversification: ETFs spread your investment across assets, helping you mitigate risks. If one asset underperforms, others balance it out.

- Liquidity: ETFs can be bought and sold on exchanges, allowing you to enter or exit positions quickly.

- Cost-Effectiveness: ETFs often come with lower fees than mutual funds, meaning more money goes into your investment rather than management fees.

What is a Crypto ETF?

Definition of Crypto ETFs

Let’s shift gears to Crypto ETF meaning. Just like traditional ETFs track the value of stocks, commodities, or other financial assets, a Crypto ETF tracks the value of one or more cryptocurrencies. Think of it as a bridge between traditional finance and the crypto world, making it easier for everyday investors to dip a toe in digital assets without diving into the crypto market.

Most Crypto ETFs track the value of big names like Bitcoin or Ethereum, although some may focus on a basket of different cryptocurrencies to spread risk. The idea is simple: buy a share in the ETF, and you indirectly invest in the cryptocurrency, gaining exposure to its price movements without needing a crypto wallet, private keys, or the sometimes clunky process of dealing with exchanges.

How Crypto ETFs Function

Answering what is Crypto ETF, we should mention they can operate in a few ways, depending on the structure of the fund and the regulatory framework of the country they’re listed in. Some Crypto ETFs hold physical cryptocurrency—meaning they buy and store digital assets like Bitcoin or Ethereum. Others, especially those based in the U.S., use derivatives - futures contracts, to replicate the price movements of these assets due to regulatory limitations.

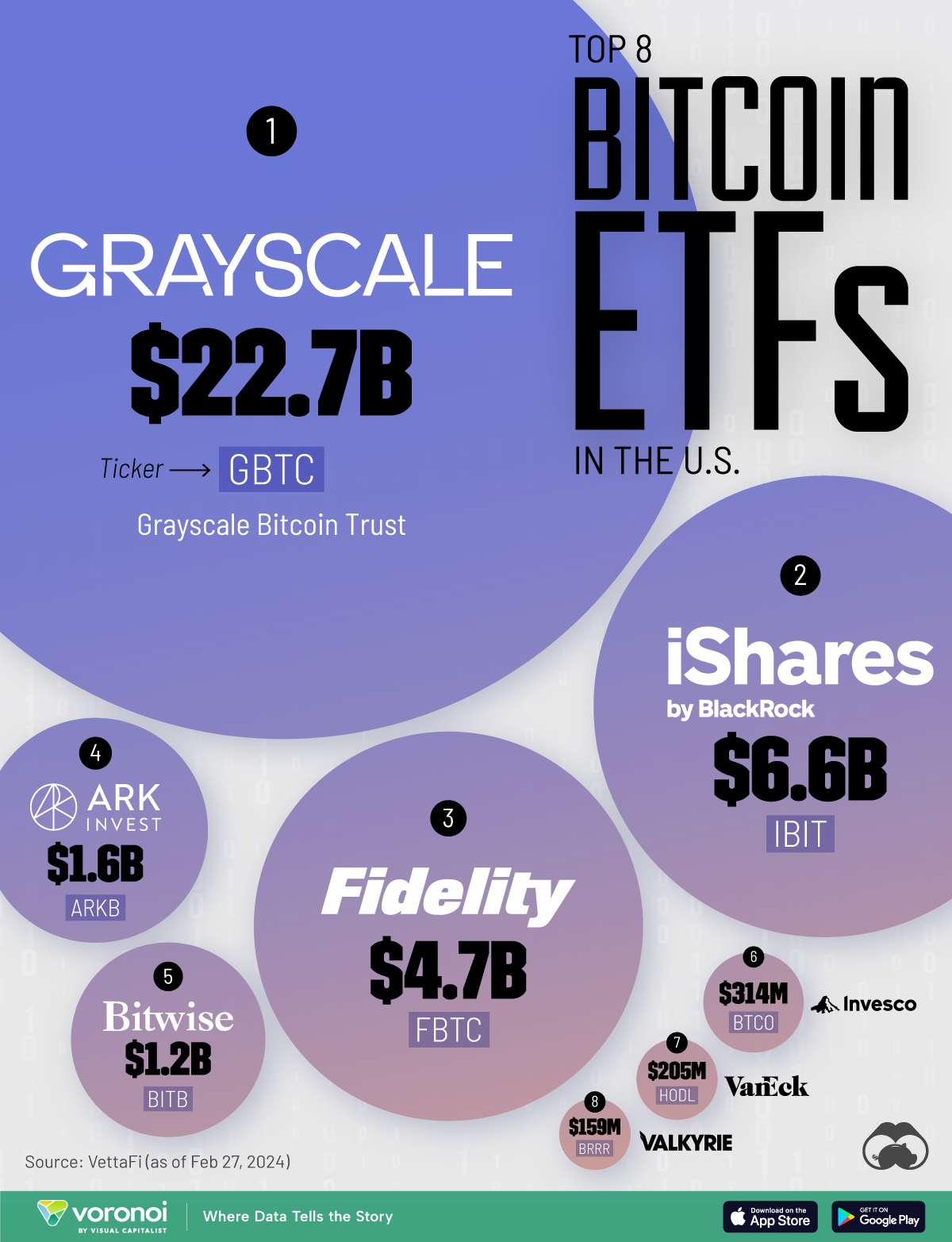

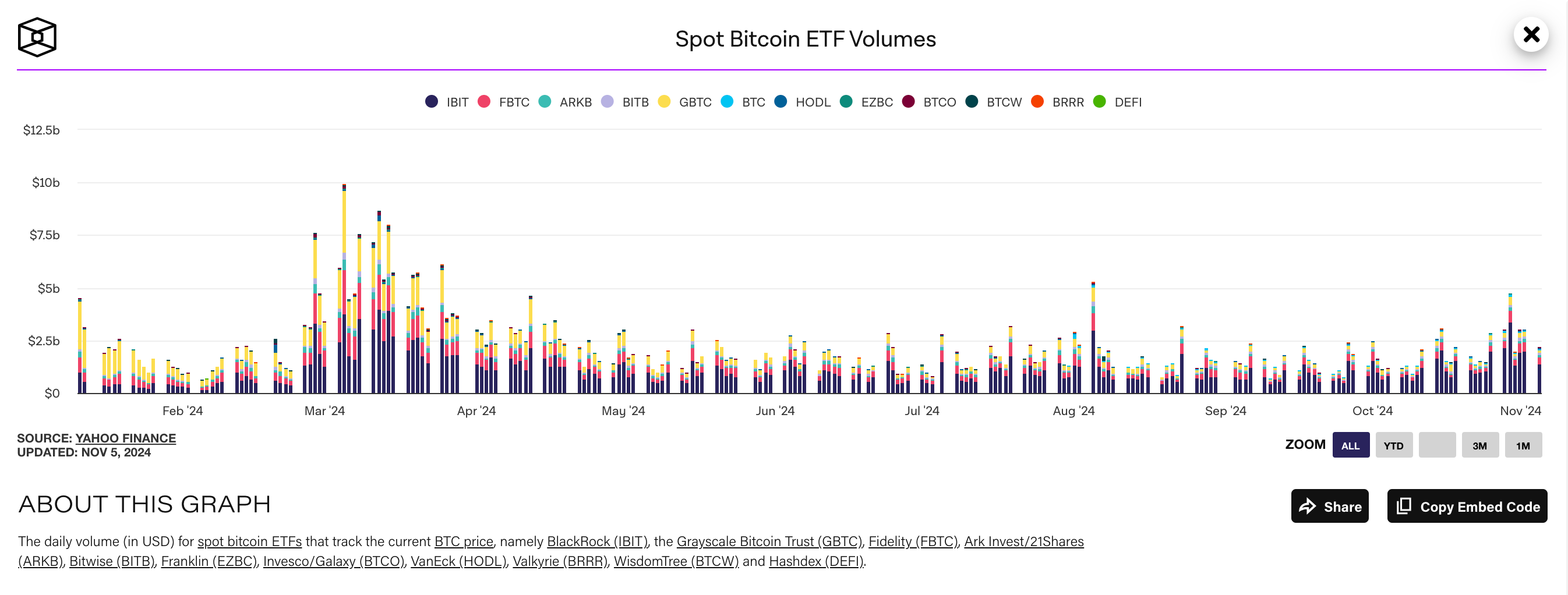

Regarding the infographics posted, the data (as of Feb 27, 2024) is outdated since BlackRock has been a new BTC ETF leader for a while. You can use this source to get updated values (there are several but as an example). Still, the visual is so appealing that we should use it anyway.

Let’s go back to what is crypto ETF and how it functions. For instance, a Bitcoin ETF might hold Bitcoin futures contracts instead of actual Bitcoins. This approach allows the fund to mirror Bitcoin’s price movements without dealing with the security challenges of storing digital assets. Futures-based Crypto ETFs have grown in popularity and have recently seen significant inflows, highlighting a growing institutional interest in crypto.

Differences Between Crypto ETFs and Traditional ETFs

Crypto ETFs are relatively new, and they differ from traditional ETFs in a few notable ways:

- Underlying Assets: Traditional ETFs are based on assets like stocks, bonds, or commodities. Crypto ETFs, however, are tied to the Wild West of digital assets, which are notoriously more volatile.

- Regulation: Traditional ETFs operate within well-established regulatory frameworks. Regulatory scrutiny is often higher for Crypto ETFs, as governments and financial authorities work to manage the unique risks associated with digital assets.

- Market Dynamics: Cryptocurrencies can experience extreme price swings due to market sentiment, news, or macroeconomic factors, which means Crypto ETFs may have higher volatility. In contrast, traditional ETFs tracking stocks or bonds are typically more stable, although they’re still subject to market fluctuations.

Benefits for Investors

For those intrigued by crypto but cautious about diving in, Crypto ETFs offer a blend of benefits that make this investment class more accessible:

- Simplified Access: Crypto ETFs remove headaches associated with buying, storing, and securing digital assets. There’s no need to handle digital wallets, private keys, or exchanges—you just buy shares in the ETF through your brokerage account.

- Reduced Risk Exposure: By investing in a Crypto ETF, you get exposure to the cryptocurrency market without the full risk of holding individual coins, which can be incredibly volatile. ETFs often diversify holdings, so any single asset's extreme price movements don’t entirely dictate the ETF’s performance.

Crypto ETF meaning is to make crypto more accessible for everyday investors, offering a lower-risk entry point to the crypto market without the commitment of learning crypto-specific tech or navigating new exchanges. For conservative investors, Crypto ETFs can be a less intimidating way to step into the crypto universe.

Recent Market Developments in Crypto ETFs

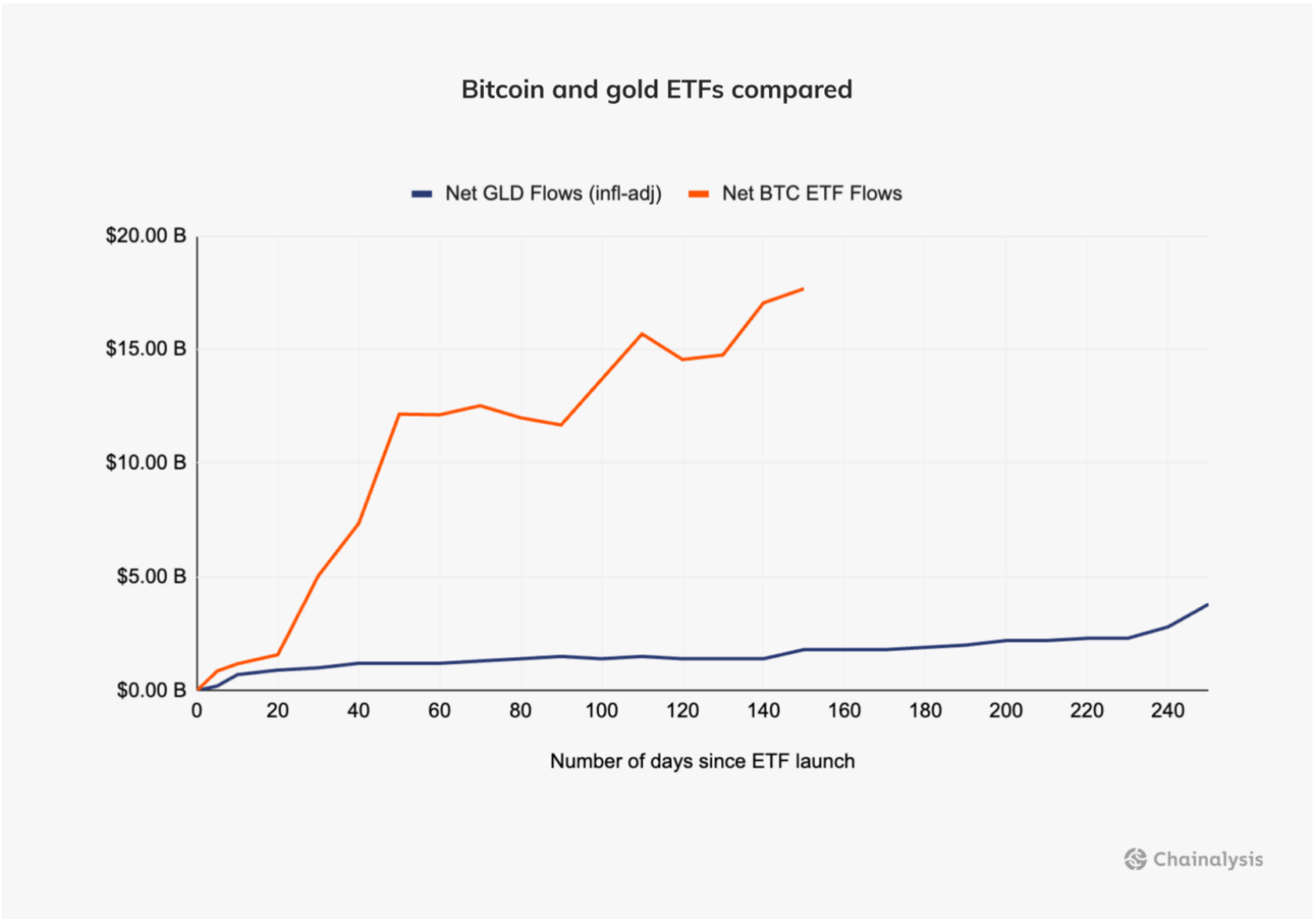

Surge in Bitcoin ETF Inflows

Bitcoin ETFs have made headlines in recent months with record-breaking inflows, attracting billions of dollars in just weeks. During one notable week, Bitcoin ETFs saw $2 billion in inflows, signaling that traditional finance is increasingly taking crypto seriously. Wall Street views Bitcoin as a high-beta investment—a fancy term for an asset that can outperform in favorable economic conditions but may amplify losses in downturns.

But why does this matter? Such inflows reflect a shift in sentiment. The influx of institutional capital into Bitcoin ETFs suggests that Bitcoin is not only seen as a speculative asset anymore; it’s becoming a part of larger investment strategies. This surge also reinforces Bitcoin’s position as the flagship cryptocurrency, with Wall Street taking a bullish stance on its long-term value.

Institutional Interest in Ethereum ETFs

While Bitcoin often hogs the spotlight, Ethereum is carving out its niche. Ethereum ETFs, which have lagged in popularity compared to Bitcoin ETFs, recently recorded net inflows of approximately $80 million. This might seem modest compared to Bitcoin’s billion-dollar inflows, but it marks a positive shift, indicating that institutional players are warming up to Ethereum’s potential.

Why the shift? Ethereum’s versatility as a blockchain platform—supporting everything from decentralized finance (DeFi) to NFTs—makes it an attractive investment for those who believe in blockchain’s broader applications beyond a simple store of value. Wall Street’s growing interest in Ethereum ETFs shows a recognition that Ethereum’s tech could play a significant role in future financial systems.

Impact on the Crypto Market

So, what does all this mean for the broader crypto market? When institutional investors pour billions into Bitcoin or millions into Ethereum ETFs, it’s a powerful vote of confidence. Large inflows into Bitcoin ETFs recently accounted for nearly 30,000 Bitcoins—far exceeding Bitcoin’s new supply. This activity can increase prices and signal other investors a bullish outlook for crypto, especially for Bitcoin.

When institutional money flows into the market, it has ripple effects. It can create positive price momentum, attracting retail investors to join the trend. Second, it validates Bitcoin and Ethereum as credible assets, not just for tech enthusiasts but for financial heavyweights, too. In the medium to long term, such institutional involvement might lead to more stability in the crypto market, though volatility will always be part of the game, given crypto’s nature.

In short, recent developments in Crypto ETFs highlight a broader trend: major financial players are warming up to digital assets. This evolution is a big deal for those considering dipping into crypto, as it signifies a growing acceptance of these assets within traditional finance circles. For newcomers, this trend could mean more opportunities to invest in crypto in a structured, lower-risk way through ETFs without the rollercoaster experience of direct crypto trading.

What is the Best Crypto ETF?

Overview of Top Crypto ETFs

For those venturing into Crypto ETFs, some have emerged as market leaders, particularly Bitcoin and Ethereum ETFs. Bitcoin ETFs have seen substantial inflows from institutional investors. While lagging behind Bitcoin in both AUM and inflows, Ethereum ETFs gradually gain traction as Ethereum’s potential for broader applications (DeFi and NFTs) becomes more understood and valued.

While there isn’t a single “best” Crypto ETF universally, the leading ETFs focus on two digital giants, allowing investors to choose depending on their interest: Bitcoin for those who view it as a digital store of value, or Ethereum for those intrigued by its diverse applications and growth potential.

Criteria for Evaluating Crypto ETFs

Answering what is the best Crypto ETF requires understanding key metrics and considerations:

- Assets Under Management (AUM): This figure indicates how much money is invested in the ETF. Higher AUM suggests greater investor confidence and liquidity. More liquidity translates to smaller bid-ask spreads, meaning you get fairer prices when buying or selling.

- Expense Ratio: ETFs charge fees to cover management costs, expressed as an expense ratio. Lower expense ratios mean more money stays in your investment rather than being eaten up by fees, which can significantly affect your returns over time.

- Tracking Accuracy: Ideally, an ETF should closely mirror the performance of its underlying asset(s). Some ETFs are better at this, especially those holding actual crypto (like spot ETFs), versus those using derivatives, which can introduce tracking errors.

- Market Performance: Recent inflows, trading volumes, and price actions can signal where the market sees potential. If a particular ETF is seeing notable inflows, it might suggest that investors believe the underlying cryptocurrency is becoming a more mainstream investment.

Considerations for Conservative Investors

For those seeking a conservative approach to what is the best crypto ETF, not all Crypto ETFs are created equal. Consider these aspects:

- Stability of Holdings: Look for ETFs investing in established cryptocurrencies like Bitcoin and Ethereum, which have a track record and broader adoption. They’re less prone to the sudden volatility that newer, less established coins might experience.

- Regulatory Compliance: Since Crypto ETFs face regulatory scrutiny, look for ETFs operating in jurisdictions with clear regulatory guidelines. An ETF operating under strict oversight can add a layer of security, ensuring the fund follows legal standards designed to protect investors.

- Market Trends: Watching for larger trends, such as “whale” (large investors) accumulation or changes in miner reserves, can offer insight into market sentiment. While this isn’t a perfect science, some conservative investors consider these signals to gauge whether crypto is likely headed into a bullish or bearish phase.

Choosing the best Crypto ETF means balancing your risk tolerance with a fund’s asset base, expenses, and regulatory compliance. For newcomers, conservative ETFs with established assets and lower expense ratios are often a sound choice.

What is a Spot ETF in Crypto?

Definition of a Spot Crypto ETF

A spot Crypto ETF is an ETF that holds the actual cryptocurrency it tracks—such as Bitcoin—rather than relying on derivatives or futures contracts. This setup means the ETF buys and holds the actual coins in a secure custody solution, tracking the cryptocurrency’s price directly. This approach allows for more accurate price tracking since the ETF’s performance is tied to the actual market price of the crypto asset, not the value of a derivative.

Spot ETFs are highly anticipated in crypto community because they provide direct exposure to the underlying cryptocurrency, appealing to those who want to invest in crypto without wallets, keys, or exchanges. However, spot ETFs have faced regulatory hurdles, particularly in the United States, where approval has been slow due to concerns about the volatility and security of digital assets.

Differences from Futures-Based Crypto ETFs

There’s a major distinction between spot ETFs and futures-based ETFs:

- Spot ETFs: These hold the actual cryptocurrency, meaning that if you invest in a spot Bitcoin ETF, the fund physically holds Bitcoins on your behalf. This setup provides direct exposure to Bitcoin’s price movements and allows for a purer reflection of the crypto’s market price.

- Futures ETFs: In contrast, futures-based ETFs don’t hold the actual asset but futures contracts—agreements to buy or sell the asset at a future date for a specified price. Futures ETFs can face challenges like contango, where the futures price is higher than the current market price, leading to tracking errors that make them less accurate in reflecting the true value of the cryptocurrency.

Pros and Cons of Spot Crypto ETFs

Spot ETFs come with distinct advantages and disadvantages:

Pros:

- Closer Alignment with Market Price: Spot ETFs track the actual asset price, more accurately reflecting the cryptocurrency’s value.

- Transparent Holdings: Since spot ETFs hold the physical asset, it’s easy for investors to understand what they’re investing in, especially compared to futures contracts that might introduce complex pricing dynamics.

Cons:

- Regulatory Hurdles: Due to the challenges in managing the security and custody of physical cryptocurrencies, spot ETFs face tougher regulatory scrutiny and, in some regions, remain unapproved.

- Custody Challenges: Holding large quantities of cryptocurrencies poses security risks, and there’s the constant threat of hacking, requiring top-notch custodial solutions.

For investors wary of futures contracts’ potential pitfalls, spot ETFs offer a more straightforward investment in crypto, though they may come with added regulatory and security considerations. Speaking of what is a Spot ETF, the answer is simple: Spot ETFs could become a game-changer for conservative investors if they gain more comprehensive regulatory approval, providing a cleaner and more transparent way to gain exposure to cryptocurrency assets in traditional investment portfolios.