The Crypto Paycheck Dilemma

Picture this: It's payday. Your crypto wallet pings, and boom – there's a fresh stack of USDT waiting for you. Sweet, right? But as you eyeball your growing pile of digital dollars, a nagging thought creeps in: "Is this money really working for me?"

Sure, you're crushing it in the Web3 world, coding DApps by day and dreaming in blockchain by night. But between juggling projects, herding the kids to soccer practice, and trying to remember if you fed the cat (you did, relax), your hard-earned crypto is just... sitting there. Static. Boring. About as exciting as watching paint dry on the blockchain.

You know you should be doing something smart with it. Maybe invest? But ugh, the thought of navigating another complex DeFi protocol makes your brain hurt. Swap this, stake that, provide liquidity here—it's enough to make you want to stuff your USDT under a digital mattress.

But here's the kicker: in the fast-paced world of crypto, standing still is like moving backward. Inflation's nibbling at your stash, and opportunities are zipping by faster than you can say "gas fees."

So, what's a savvy Web3 worker to do? How can you make your digital dollars work as hard as you do, without needing a Ph.D. in tokenomics? Buckle up, fellow crypto earners—we're about to dive into the world of the best stablecoins and discover how they can be your ticket to financial zen.

Stablecoins: Your Digital Dollars

Alright, let's break this down without the usual crypto jargon that makes your eyes glaze over faster than a frozen browser.

Stablecoins are like the responsible adults at the wild crypto party. While other cryptocurrencies are doing the price cha-cha, stables are chillin' by the punch bowl, keeping it steady. They're designed to maintain a stable value, usually pegged to a real-world asset like the US dollar.

Think of them as your favorite comfort food in the unpredictable buffet of crypto. No matter how crazy the market gets, one USDT, USDC, or DAI is always meant to equal one dollar. It's like having a rock to cling to in the stormy seas of cryptocurrency.

Now, let's meet the power trio of the best stablecoin 2024:

1. USDT (Tether): The OG of stablecoins. It's been around the block and is as common in the crypto world as coffee is in a coder's diet.

2. USDC: The new kid on the block that's quickly becoming the teacher's pet. Known for its transparency and regulatory compliance.

3. DAI: The decentralized darling. It's like the indie band–not as mainstream, but with a die-hard fan base.

These three are your go-to digital dollars. They're widely accepted, easily tradeable, and perfect for when you want to take a breather from the roller coaster of other cryptocurrencies.

Best Stablecoin to Hold: 10 Players in the Digital Dollar Game

Alright, crypto aficionados, let's dive into the diverse world of best stablecoins. It's like a buffet of digital stability—there's something for everyone. Here's your rundown of 10 stablecoins, each with its own flavor:

1. Tether (USDT): Widely used, but occasionally controversial. Like that friend who's always invited to the party, despite the drama.

2. USD Coin (USDC): The golden child. Transparent and regulator-friendly. It's the coin your parents would approve of.

3. Dai (DAI): The decentralized dream. Crypto-collateralized and community-governed. For those who take their decentralization with extra decentralization.

4. TrueUSD (TUSD): The trust-focused option. Known for its regular audits. It's like having a transparent piggy bank.

5. Pax Dollar (USDP): The rebranded veteran. Formerly Paxos Standard, it's like the friend who got a makeover.

6. Gemini Dollar (GUSD): The Winklevoss twins' brainchild. Regulated and exchange-backed. It's the preppy kid of stablecoins.

7. HUSD: Huobi's offering. It's popular in Asian markets. It's like the exchange student in your crypto class.

8. USDD: Tron's algorithmic stable. Because Justin Sun never met a crypto trend he didn't like.

9. Liquity USD (LUSD): Backed by ETH, governance-free. It's the minimalist's stablecoin.

10. Pax Gold (PAXG): Gold-backed for the digital age. For when you want your crypto as shiny as real metal.

Each of these stables has its unique selling points, whether it's the backing mechanism, the governing body, or the blockchain they call home. Some are fiat-collateralized, others crypto-collateralized, and a few are algorithmic or hybrid models. Your choice depends on your needs – liquidity, decentralization, transparency, or specific blockchain compatibility.

Remember, in the world of stablecoins, one size doesn't fit all. It's all about finding the right fit for your digital wallet!

Why Stablecoins Are Your New Best Friend

Imagine having a friend who's always reliable, ready to hang out at a moment's notice, and never flakes on you. That's what the safest stablecoins are in the crypto world – your dependable digital buddy.

First off, stability is their superpower. While Bitcoin and Ethereum are off on their wild price adventures, stablecoins are the calm in the storm. Your $100 worth of USDT today? It'll still be about $100 tomorrow, next week, and next month. It's like having a financial anchor in the choppy crypto seas.

But here's where it gets really cool for us Web3 workers. Need to pay your virtual assistant in the Philippines? Stablecoins. Want to split the bill for that team-building escape room? Stablecoins. Saving up for that sweet new ergonomic chair? You guessed it – stablecoins.

They're the Swiss Army knife of crypto. You can use them for everyday transactions without worrying about the value changing faster than you can click "send." Plus, when you do want to dive back into the more volatile crypto waters, stables are your perfect jumping-off point.

Think of the safest stablecoins as your crypto home base. A place where you can park your earnings, catch your breath, and plan your next move. They give you the flexibility to play the crypto game on your terms, without the constant pressure of price watching.

In short, stables are like that reliable friend who's always got your back – financially speaking, of course.

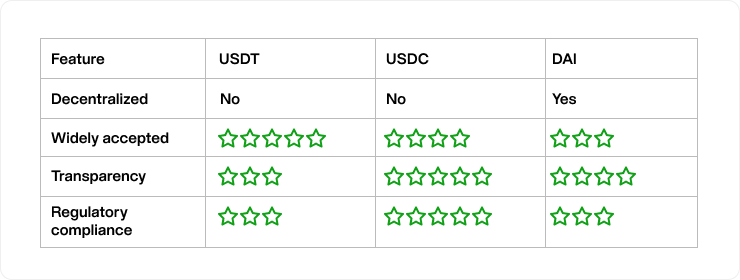

The Best Stablecoin Smackdown: USDT vs. USDC vs. DAI

Ladies and gentlemen, welcome to the main event! In the blue corner, weighing in with a market cap that could make small countries jealous, we have the reigning champion – USDT! In the red corner, the people's choice for transparency, USDC! And in the green corner, the decentralized underdog with a fierce following, DAI!

Let's break down this three-way bout:

USDT (Tether):

- The heavyweight champ with the biggest market share

- Found everywhere from major exchanges to your local crypto café

- Has taken a few regulatory jabs but keeps bouncing back

- Perfect for when you need liquidity faster than you can say "blockchain"

USDC:

- The rising star known for playing by the rules

- Backed by some big names in both crypto and traditional finance

- Transparent about its reserves, like that one friend who overshares on social media

- Ideal for those who like their stablecoins with a side of regulatory compliance

DAI:

- The decentralized darling that doesn't need no banks

- Backed by other cryptocurrencies, because who needs fiat anyway?

- Governed by its community, like a crypto co-op

- Great for the true believers in decentralization

Here's a quick comparison table to help you keep score:

Remember, in this match, you can be friends with all the fighters. Mix and match based on your needs, because in the world of stablecoins, diversification is your tag-team partner!

Stashing Your Stash: Smart Ways to Use Stablecoins

So, you've got your stablecoins. Now what? Let's turn that digital dough into some serious crypto cheddar.

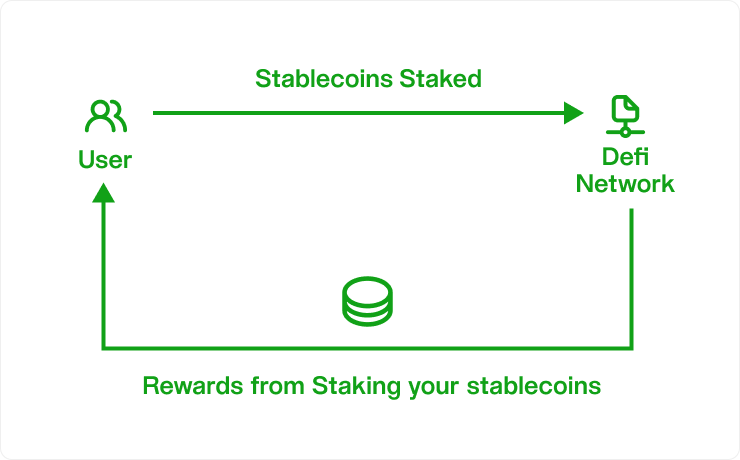

Enter the world of staking and yield farming – fancy terms for "making your money work while you sleep." It's like planting your stables in fertile DeFi soil and watching them grow.

Staking is like putting your stablecoins in a high-yield savings account, but way cooler. You lend your coins to a platform, they use it to keep their system running smoothly, and you earn interest with the best stablecoin staking. It's a win-win, like finding out your favorite coffee shop now delivers.

Yield farming is the overachiever of the bunch. It's a bit more complex, involving lending your stablecoins across different platforms to maximize returns. Think of it as being a digital landlord, but instead of dealing with leaky faucets, you're juggling APIs and smart contracts.

Now, there are plenty of platforms out there offering to grow your stablecoin stash. Some promise returns that'll make your eyes pop out like a cartoon character. But remember, if it sounds too good to be true, it probably is. Look for platforms with a solid reputation, good security measures, and realistic returns.

The beauty of stashing your stablecoins this way? You're earning passive income without the heart-stopping volatility of other crypto investments. It's like getting the excitement of crypto gains with the steadiness of a good night's sleep.

So go ahead, plant those stable seeds, and watch your digital garden grow!

The Stablecoin Safety Net

Let's face it – in the Wild West of crypto, safety is sexier than a perfectly executed smart contract. So how do we keep our beloved stablecoins safer than a hardware wallet in a bank vault?

First things first – not all stables are created equal. Like choosing a babysitter for your precious crypto kids, do your homework. Look for stablecoins with a track record of maintaining their peg, regular audits, and a transparent reserve system. It's like checking references but for your digital dollars.

When it comes to storage, think of your stablecoins as digital gold. You wouldn't leave gold bars on your coffee table, right? Same goes here. Hardware wallets are your new best friend – they're like a personal Fort Knox for your crypto. For day-to-day use, reputable software wallets can do the trick but always enable two-factor authentication. It's like having a bouncer for your digital nightclub.

Be wary of phishing attempts. If someone's offering you a "special deal" on stables, run faster than you would from a rug pull. Legitimate stablecoin transactions don't need you to "verify your wallet" by entering your seed phrase.

Remember, in the world of stablecoins, boring is beautiful. Stick to reputable exchanges, keep your coins in secure wallets, and always triple-check addresses before sending. Your future self will thank you, probably with a lambo.

Future-Proofing Your Finances with Stablecoins

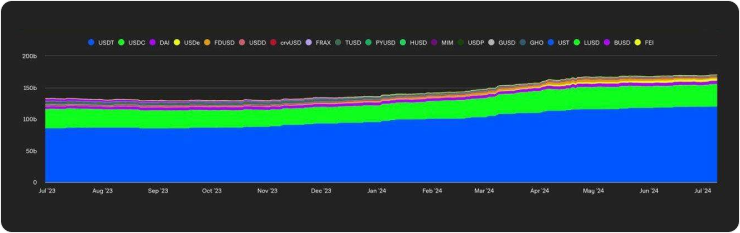

Alright, crystal ball time. What's the future got in store for our steady digital friends? Spoiler alert: stablecoins aren't just a flash in the crypto pan.

Regulations are coming, and like that software update you've been putting off, they're inevitable. But don't panic! For legit stablecoins, regulation could be like a seal of approval. It's like when your favorite indie band goes mainstream – sure, things change, but now your mom might finally understand what you do for a living.

The European Union's MiCA regulations are like the strict parent at the crypto party. They're setting ground rules for stablecoins, ensuring they're actually, you know, stable. For us Web3 workers, this could mean more protection and less "trust me, bro" in the stablecoin world.

Looking ahead, stablecoins are set to become the backbone of the Web3 economy. Imagine salary payments, cross-border transactions, and even your morning coffee purchase, all seamlessly handled with stables. It's like the current financial system, but without the papercuts and soul-crushing wait times.

For Web3 workers, this means more opportunities. As stablecoins become more integrated into everyday finance, your skills become even more valuable. You're not just a coder or a marketer; you're a pioneer in the future of money.

So, while you're building the decentralized future, let stablecoins be your trusty financial sidekick. They're here to stay, and they're ready to grow with you.

Your Stablecoin Action Plan

Alright, future stablecoin mogul, ready to put all this knowledge into action? Here's your step-by-step guide to success, no computer science degree required:

1. Choose Your Fighter: Pick a reputable one. USDT, USDC, and DAI are solid starts. It's like choosing a starter Pokémon, but for your finances.

2. Get a Wallet: Set up a secure wallet. Hardware for savings, software for everyday use. Think of it as a digital piggy bank, but cooler.

3. Make the Switch: Next payday, convert a portion of your earnings to stablecoins. Start small – maybe 10%. It's like dipping your toes in the pool before cannonballing in.

4. Stash and Earn: Look into best stablecoin staking options. Find a reputable platform with good rates and easy unstaking. It's passive income, without the hassle of becoming a landlord.

5. Use It: Pay for services in stablecoins when you can. It's like using a credit card, but you're basically your own bank.

6. Stay Informed: Keep an eye on stablecoin news. Set up some alerts. Knowledge is power, and in crypto, it's also money.

7. Diversify: Don't put all your eggs in one stablecoin basket. Spread the love around.

Remember, this is a marathon, not a sprint. Take it step by step, and before you know it, you'll be savvy about stablecoin. Welcome to the future of finance—I hope you enjoy your stay!