There are several countries where USDT has become the "new black." The adoption of crypto in these regions is enormous, driven by demographic, economic, and migrational factors. When examining cryptocurrency usage worldwide, the leader is clear: Tether (USDT). In this article, we'll explain the meaning of USDT, its benefits, restrictions, and the associated risks. Whether you're looking for a stable asset in a volatile market or a quick and low-cost transaction solution, USDT offers unique advantages.

Statistics and Infographics on USDT Adoption

Leading Countries in Crypto Adoption

USDT has seen significant adoption across various countries. In Brazil, it accounts for 80% of all cryptocurrency transactions, amounting to approximately $55 billion so far in 2023, showcasing its dominance in the region. In Asia, especially China, Tether transaction volumes remain high due to its use in over-the-counter (OTC) trading desks to circumvent strict capital controls, with volumes reaching over $10 billion per month.

Global Adoption Trends

USDT is widely used across major exchanges in both Western and Asian markets. High trading volumes in the U.S. and Europe highlight its growing institutional adoption. For instance, U.S. exchanges like Coinbase and Kraken report substantial USDT trading volumes, reflecting its importance in the crypto trading ecosystem.

-740x490.png)

Source: https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/

Demographic Insights

USDT usage spans various demographic groups, from retail traders to institutional investors. It serves as an essential tool for liquidity, trading, and cross-border transactions, making it a versatile asset in the crypto world.

-740x490.png)

Source: https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/

These statistics underline the widespread adoption and utility of crypto, and USDT in particular, reinforcing its position as a crucial stablecoin in the global cryptocurrency market.

What is USDT currency?

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. It's designed to maintain a stable value by being pegged to a traditional currency like the US dollar. Unlike other cryptocurrencies that experience high volatility, USDT’s value remains constant, making it a reliable choice for many users.

Purpose and Use

What is USDT used for? It is primarily used for trading, hedging against volatility, and as a means of transferring value quickly and securely. It allows users to move funds between exchanges quickly, without the need to convert to fiat currency, thus saving on conversion fees and avoiding market volatility.

Key Features:

- Stable Value: Pegged to the US dollar, ensuring low volatility.

- Widely Accepted: Accepted on major exchanges worldwide, facilitating easy trading.

- Secure Transactions: Ensures secure and quick transactions across various platforms.

USDT serves as a crucial tool in the crypto ecosystem, acting as a bridge between the traditional financial system and the digital asset space. It provides the following specific benefits:

1. Mitigation of Market Risk: By converting volatile cryptocurrencies into stables, investors can protect their portfolios from sudden market downturns.

2. Deep onchain liquidity: USDT is paired with the most traded assets on decentralized exchanges and can be lent or borrowed in the biggest lending protocols.

3. Transaction Medium: Due to its stable value, stablecoin is frequently used for day-to-day transactions in regions with unstable local currencies, providing a reliable store of value and medium of exchange.

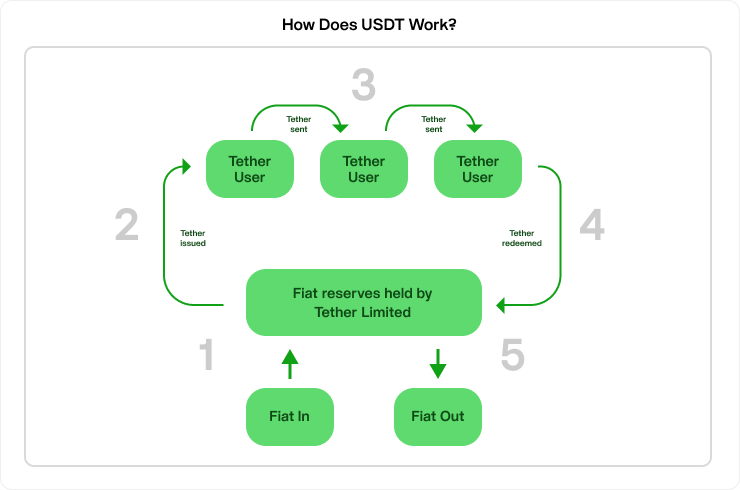

How Does USDT Work?

Mechanism

USDT maintains its stability through a reserve of fiat currency that backs each token issued. This means that for every stablecoin in circulation, there is an equivalent amount of US dollars held in reserve by Tether Limited, ensuring its value remains consistent. This mechanism is known as a one-to-one peg, where one USDT is equivalent to one USD.

Fiat Reserve:

- Tether Limited claims to hold USD reserves equivalent to the USDT in circulation.

- Regular attestations are published by third-party firms to verify these reserves.

Blockchain Integration

Speaking about what chain is USDT on, it can be issued on various blockchains, including Ethereum (ERC20), TRON (TRC20), and others. The TRON network, in particular, offers benefits such as lower transaction fees and faster processing times compared to Ethereum.

TRC20 Standard:

- Fast Transactions: TRC20 transactions are processed quickly, making them suitable for frequent use.

- Low Fees: Transaction fees on the TRON network are minimal, making it cost-effective for users.

- Compatibility: Integrated with numerous wallets and exchanges, ensuring widespread usability.

Detailed Mechanisms

To maintain its peg, Tether uses several mechanisms:

1. Issuance and Redemption: Users can deposit USD to Tether Limited and receive an equivalent amount of cryptocurrency. Conversely, they can redeem USDT for USD, ensuring the stable value is maintained.

2. Arbitrage Opportunities: Market participants engage in arbitrage when Tether deviates from its peg. If it trades below $1, they buy it and redeem for USD, profiting from the difference. This process helps stabilize the price.

3. Regulatory Compliance: Tether complies with various regulations to maintain trust and legitimacy in the financial markets, ensuring that its reserves are sufficient and transparent.

Benefits of Using USDT

Stability

Tether’s value stability provides a safe haven in the volatile crypto market, reducing the fear of losing money. This stability allows users to confidently hold coins without worrying about sudden price drops.

Financial Safeguard:

- Predictability: Users can predict the value of their holdings, unlike with volatile cryptocurrencies.

- Risk Mitigation: Reduces exposure to market fluctuations, making it ideal for preserving value.

Transaction Speed and Cost

How Long It Takes To Send USDT

USDT transactions, especially on the TRON network, are fast and come with minimal fees. This addresses the pain point of long and expensive withdrawal processes, ensuring that you can access your funds quickly and at a low cost.

Efficiency:

- Immediate Transfers: Funds can be transferred almost instantly between wallets and exchanges.

- Cost Savings: Low transaction fees mean more savings for frequent users.

Detailed Benefits

1. Global Accessibility: USDT can be used globally without the limitations of traditional banking hours, enabling 24/7 access to financial services.

2. Cross-Platform Utility: Integrated with various financial platforms, wallets, and exchanges, making it a versatile tool for multiple financial operations.

3. Transparency and Trust: Regular attestations and audits increase transparency, enhancing user trust in the stability and reliability of USDT.

USDT Meaning: Common Uses of USDT in the Crypto World

Trading and Investment

USDT meaning for traders is crucial. Traders often use USDT to protect their funds from market volatility without needing to cash out into fiat. By holding, they can quickly re-enter the market when conditions are favorable, all while avoiding the volatility of other cryptocurrencies.

Trading Strategies:

- Hedging: Traders use Tether to hedge against potential losses in volatile markets.

- Liquidity: Provides immediate liquidity for entering and exiting trades.

Payments and Remittances

Freelancers and businesses use crypto for quick, cross-border payments, avoiding traditional banking delays and high fees. USDT’s stability and low transaction costs make it an ideal option for international transactions, ensuring recipients get the full value of their payments.

Global Reach:

- Cross-Border Efficiency: Enables fast and low-cost international payments.

- Payment Security: Ensures secure transactions, protecting against fraud and chargebacks.

Additional Use Cases Showcasing the Meaning of USDT

1. Decentralized Finance (DeFi): USDT is widely used in DeFi applications for lending, borrowing, and liquidity mining, providing a stable asset in these ecosystems.

2. E-commerce: Online merchants accept Tether for goods and services, leveraging its stable value for predictable revenue.

3. Gaming and Digital Services: In-game purchases and digital services increasingly accept USDT, providing a seamless payment experience for users.

Risks and Considerations In Behalf of USDT Meaning

Regulatory Concerns

While USDT offers many benefits, it's important to be aware of potential regulatory issues. Some regulatory bodies have raised concerns about Tether’s transparency and the adequacy of its reserves. Users should stay informed about regulatory developments and choose reliable platforms for their transactions.

Regulatory Landscape:

- Transparency Issues: Concerns about whether Tether's reserves fully back all issued USDT.

- Compliance: Potential changes in regulations could impact how USDT is used and traded.

Security

Always store your USDT in a secure wallet and follow best practices to protect your assets. Use hardware wallets for long-term storage and enable two-factor authentication on your accounts to enhance security.

Security Measures:

- Secure Wallets: Use reputable wallets to store crypto securely.

- Two-Factor Authentication: Adds an extra layer of security to your accounts.

Detailed Considerations

1. Market Risks: Although Tether is stable, external market factors can influence its value. Awareness of market trends and developments is crucial.

2. Operational Risks: The operations of Tether Limited and the platforms where USDT is traded can impact its usability. Choose reputable and compliant platforms for transactions.

3. Technological Risks: Blockchain technology is constantly evolving. Staying updated on technological changes and improvements can help mitigate potential risks.

Trust Builders and Community Endorsements

Endorsements and Media Coverage

USDT is widely endorsed by reputable investors and has extensive coverage in trusted media platforms. For example, known venture capital firms and influencers in the crypto space have vouched for its reliability and utility.

Reputable Backing:

- VC Endorsements: Supported by prominent venture capital firms.

- Media Attention: Positive coverage in major financial and tech media.

Community Insights

Community discussions on platforms like Bankless often highlight Tether’s reliability and ease of use. Many users appreciate its stability and the efficiency it brings to their financial transactions.

User Testimonials:

- Positive Feedback: Users frequently share their positive experiences with Tether.

- Community Support: Strong community backing provides confidence in its use.

Additional Trust Factors

1. Transparency Reports: Regular publication of reserve attestations and audits.

2. Industry Collaborations: Partnerships with major exchanges and financial platforms enhance credibility.

3. User Education: Providing educational resources and support helps users understand and trust the platform.

Short-Term and Long-Term Financial Goals

Aligning with User Goals

Whether you need quick access to your funds or are planning for long-term financial stability, understanding what is USDT and its meaning for crypto world can help achieve your goals without the stress of market fluctuations. Tether provides a flexible solution for both short-term liquidity needs and long-term asset management.

Financial Planning:

- Short-Term Liquidity: Easily accessible funds for immediate needs.

- Long-Term Stability: A stable asset for preserving value over time.

Specific Financial Strategies

1. Emergency Fund: Use USDT as a stable reserve for emergency funds, ensuring liquidity without risk of depreciation.

2. Investment Portfolio: Integrate USDT into investment portfolios as a stable component, balancing the portfolio against market volatility.

3. Payment Buffer: Maintain a buffer of Tether for recurring payments and operational costs, ensuring stability and predictability in financial planning.

The best metaphor found around stablecoins can be seen here:

-740x490.png)

Source: https://www.chainlinkgod.com/p/the-trojan-horse-of-crypto-stablecoins

Lifestyle Integration

Relatable Content

For those with busy offline lives, USDT offers a hassle-free way to manage your finances, fitting seamlessly into your routine. Whether you're a freelancer needing quick payments or a business managing cross-border transactions, Tether simplifies your financial operations, allowing you to focus on your core activities.

Convenience:

- Seamless Integration: Easily fits into daily financial activities.

- Stress-Free Management: Reduces the complexity of managing volatile assets.

Specific Lifestyle Applications

1. Freelancers and Remote Workers: Use USDT for receiving payments from international clients, avoiding traditional banking delays and high conversion fees.

2. Travel Enthusiasts: Manage travel expenses, ensuring stable value and easy access to funds globally.

3. Small Businesses: Accept USDT for products and services, benefiting from lower transaction fees and faster processing times compared to traditional payment methods.

Conclusion

USDT provides a stable, efficient, and widely accepted option in the crypto world, addressing common pain points for daily users. Its stability, fast transaction speeds, and low costs make it an ideal choice for various financial needs.

For more in-depth information, check out resources from reputable crypto platforms and influencers. Learn more about how USDT can enhance your financial transactions and provide a stable foundation in the volatile world of cryptocurrency.