Introduction

Blockchain technology, having proved its worth with digital assets, is now evolving towards a new frontier: tokenizing of real-world assets (RWA). Unlike purely digital assets, RWA tokens are backed by physical goods, real estate, commodities, or intangible assets like intellectual property.

RWA paves the way for a global, frictionless market for all assets, where geographic boundaries and traditional financial intermediaries become increasingly irrelevant. Imagine a world where you can own a fraction of a skyscraper in New York, a vineyard in France, and a gold mine in South Africa, all managed through a single digital wallet. Sounds nice, heh?

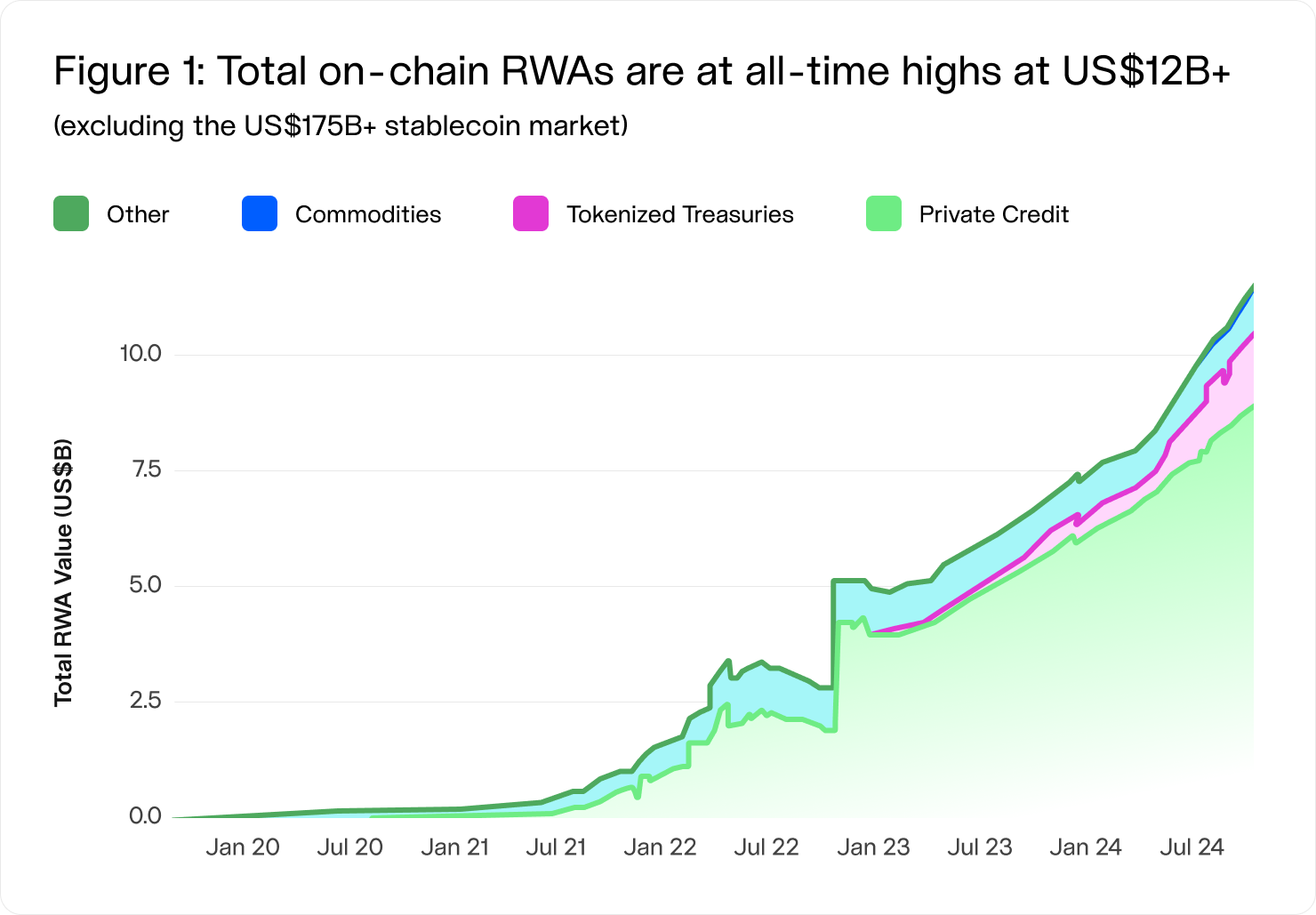

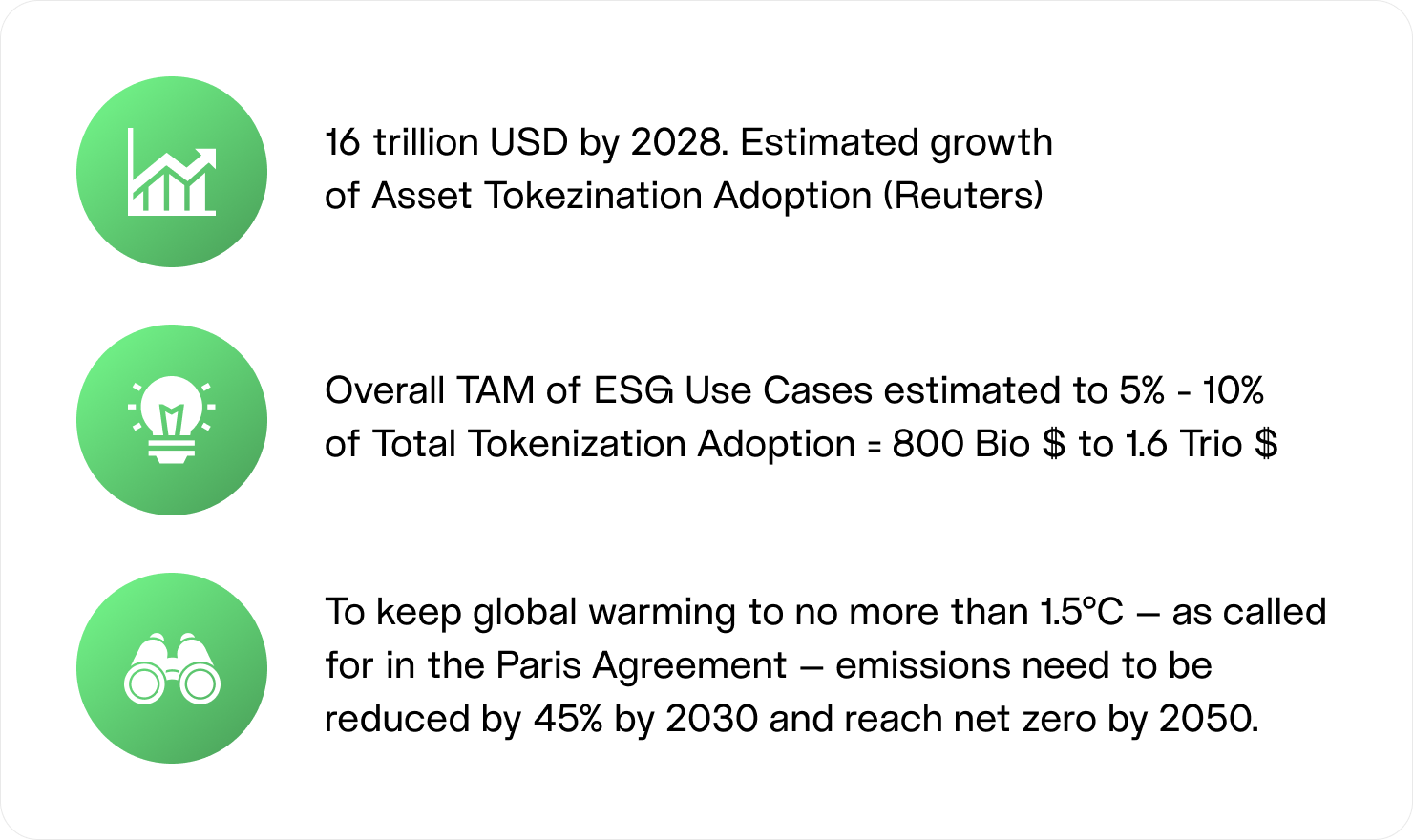

The RWA tokenization crypto market is rapidly evolving, with major players in both traditional finance and the crypto world taking notice. By July 2024, the total value of on-chain RWAs has reached $12 billion, excluding the $175 billion stablecoin market.

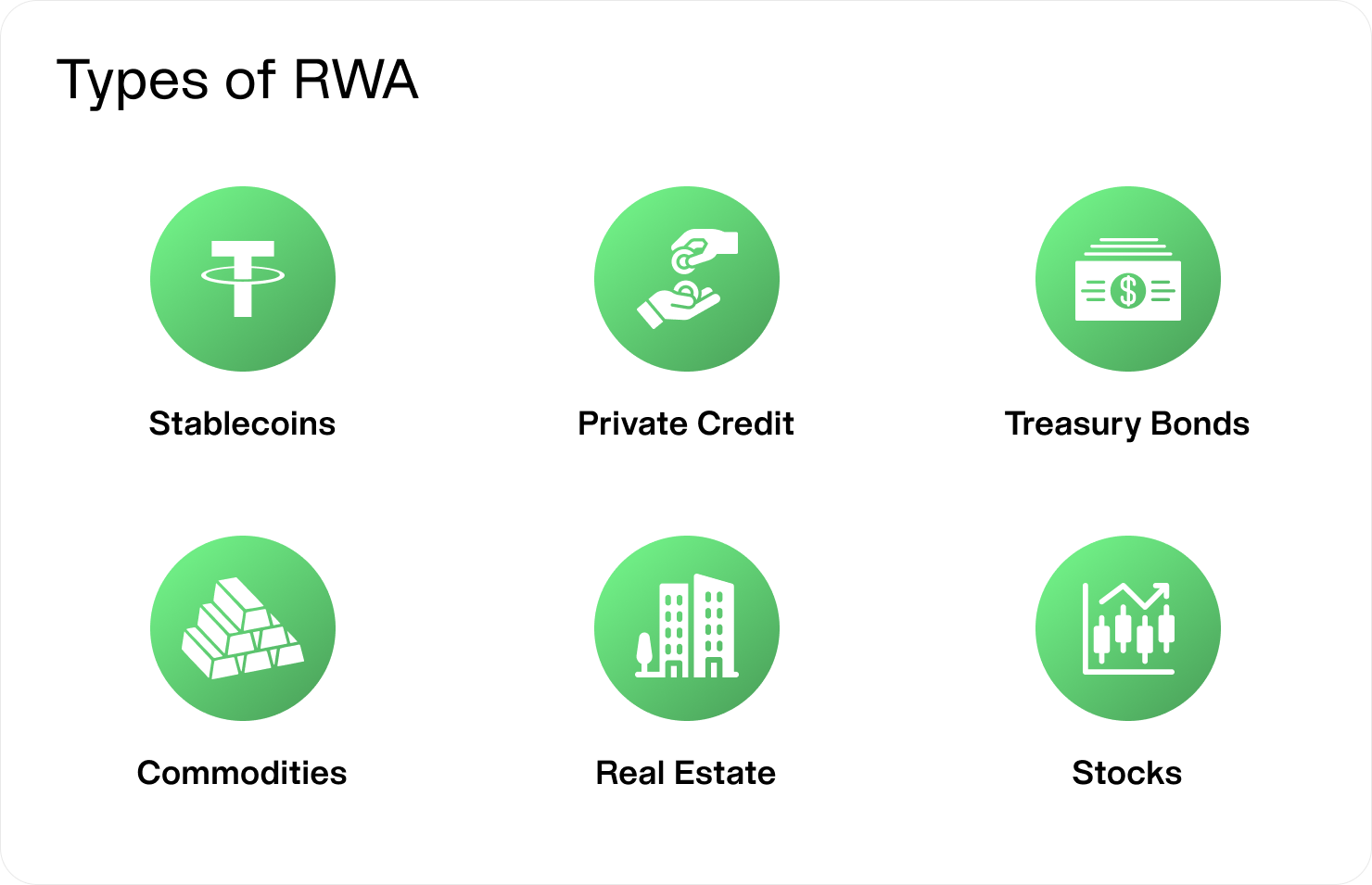

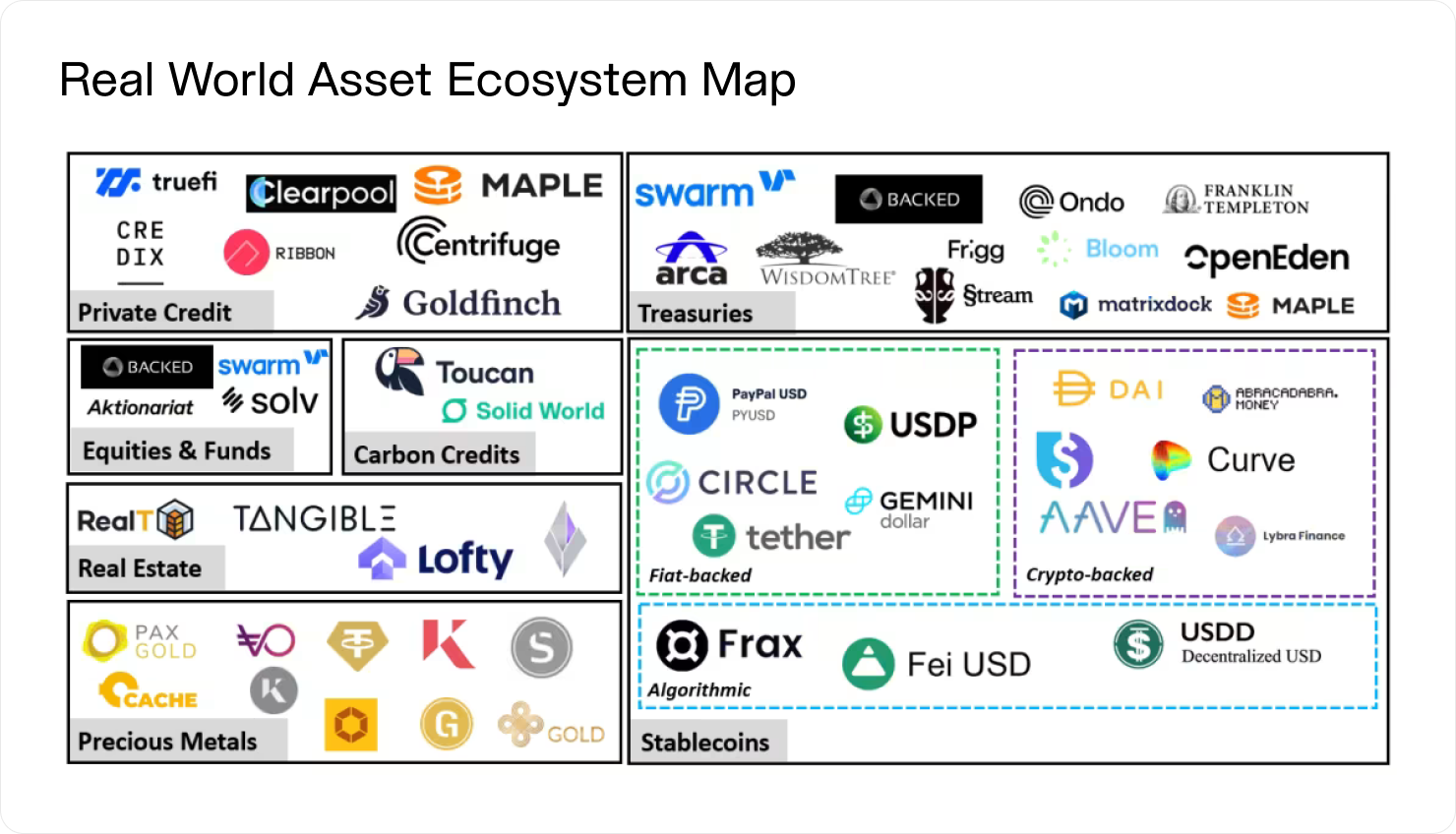

Major RWA categories include tokenized US Treasury bonds, private credit, commodities, equities, real estate, and non-US bonds. Emerging categories such as aviation rights, carbon credits, and artwork are beginning to surface.

Colin Butler, Global Head of Institutional Capital at Polygon, boldly predicted that the global market for tokenization of real world assets could reach $30 trillion.

Tokenization and the Evolution of Ownership and Markets

RWA tokenization is fundamentally reshaping our understanding of ownership and transforming traditional market structures across various asset classes. This evolution is creating new paradigms for investment, liquidity, and value exchange. Its ecosystem is already all-inclusive.

Real Estate: Fractionalizing the World's Largest Asset Class

The Global Real Estate Market, valued at USD 3.89 Trillion in 2023, represents a massive opportunity for tokenization. This potential is already being realized:

- In 2018, New York City-based asset management firm Elevated Returns completed a tokenized real estate offering for $18 million on the Ethereum blockchain. The asset was the St. Regis Resort in Aspen, Colorado. Aspen Coins were priced at $1 per coin, and all investors were required to be accredited investors with a minimum purchase of 10,000 tokens.

- Blocksquare announced the tokenization of real world assets of $100M of properties, launching its Oceanpoint v0.5 platform. This milestone includes 118 diverse assets across 21 countries, including hotels, restaurants, and healthcare facilities.

- Right-now opportunity on the market: a $195,000 villa in Bali is tokenized into 3,900 shares, each worth $50. Investors can purchase these shares and earn rental income proportional to their ownership, with smart contracts automating income distribution.

Financial Markets: Programmable Assets and Automated Compliance

Traditional financial assets are being brought onto the blockchain, expanding the reach of RWA tokenization beyond cryptocurrencies:

- JPMorgan, a banking giant, tokenized $71,000 worth of money market fund shares on the Polygon blockchain in 2022.

- Switzerland's SIX Digital Exchange (SDX) tokenizes private shares on its regulated blockchain-based Central Securities Depository in partnership with F10.

- Diamond Standard Fund (“Fund”) was tokenized by Oasis Pro and listed on Oasis Pro Market’s SEC-registered ATS.

- Liv, UAE’s first digital bank launched by Emirates NBD, signed a Memorandum of Understanding (MoU) with Ctrl Alt, a B2B alternative asset solutions provider, to explore tokenizing RWA.

- In 2024, tokenized US Treasury bonds saw explosive growth, with the market cap soaring from $769 million at the beginning of the year to $2.2 billion by September and BUIDL has become the first tokenized fund to surpass the half-billion-dollar mark within just over four months of its inception. Today’s market cap of Black Market fund is $537 millions.

Commodities: Bridging Physical and Digital Markets

Physical commodities are entering the blockchain space, offering new ways to invest in and trade tangible assets:

- Pax Gold by Paxos offers a tokenized gold token, PAXG, redeemable for one fine troy ounce of gold stored in LBMA vaults in London. Paxos Gold (PAXG) and Tether Gold (XAUT) dominate the on-chain gold market with a 98% market share, and the total market value is around $970 million.

- Golteum is a platform for fractionalized NFTs backed by physical gold bars and other metals.

- CACHE Gold provides the infrastructure to digitize physical gold and other real-world assets.

Intellectual Property: Redefining Creator Economics

Even intangible assets like IP rights are being tokenized, opening up new revenue streams and investment opportunities:

- In the music industry, platforms like Zoniqx allow artists to tokenize streaming royalties. It is not the only real world asset tokenization service existing.

- 3LAU raised $16 million for his blockchain music platform Royal and sold his tokenized album "Ultraviolet" as the most expensive single NFT token ever. However, the future is still out there: Royal.io announced they would be sunsetting the marketplace to pivot towards challenges related to AI-generated music.

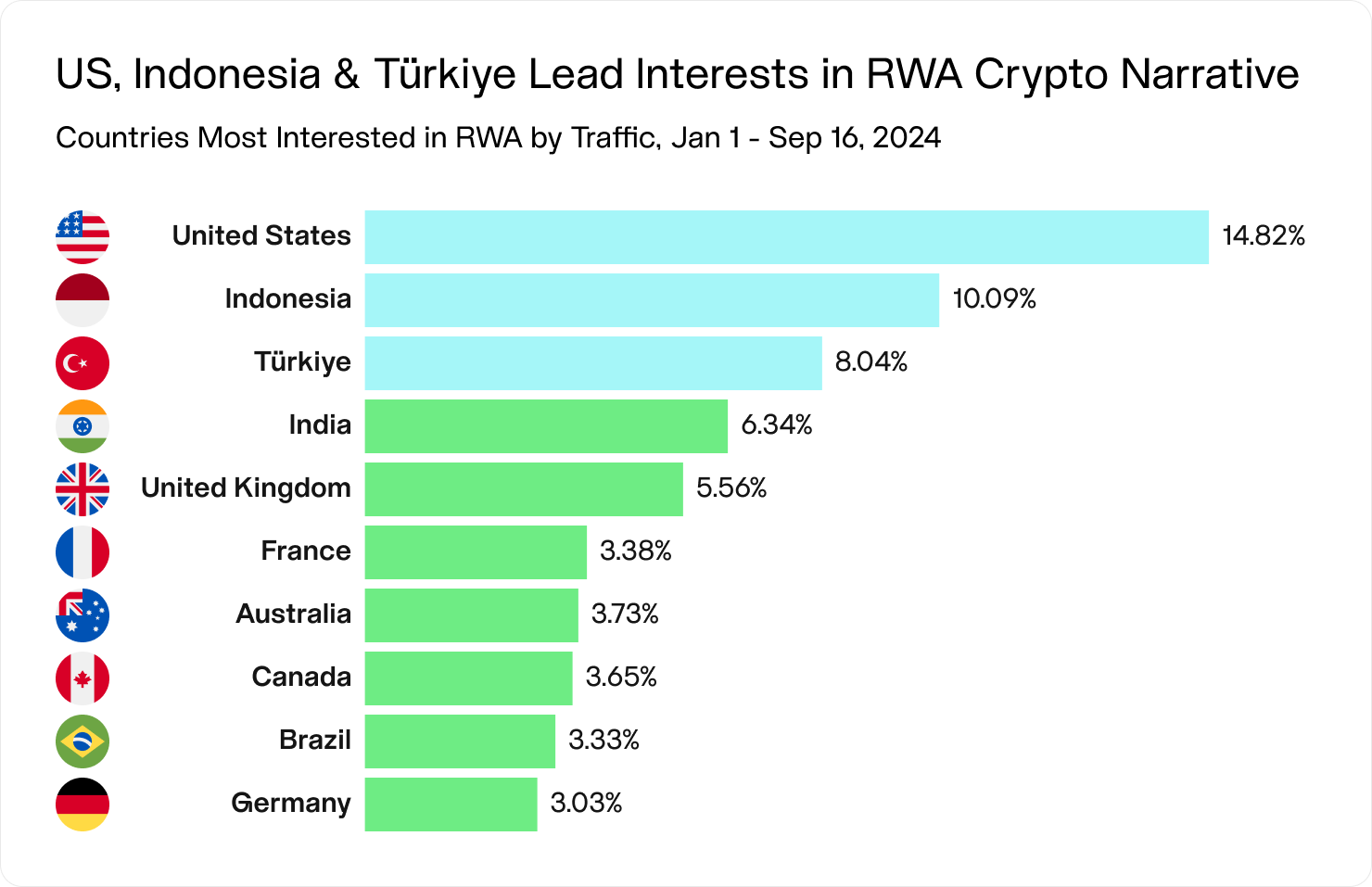

By allowing fractional ownership and automated royalty distribution, tokenization is evolving how we value and trade intellectual property, potentially transforming creator-audience relationships and investment in innovation. It is also a great chance for emerging economies to profit from a small chunk of value. While the country most interested in crypto Real World Assets (RWA) is the US, which accounts for 14.8% of global interest, the runners up are Indonesia and Türkiye, representing 10.1% and 8.0% of global interest, respectively.

RWA Tokens as a Tool for Global Resource Optimization and Sustainability

RWA tokenization isn't just about changing how we own assets; it's about revolutionizing how we allocate, use, and conserve our planet's resources. Blockchains, especially those using Proof of Work (PoW) consensus mechanisms, consume significant amounts of energy. This high energy consumption produces a larger carbon footprint, contributing to environmental degradation.

RWA tokenization could play a crucial role in the efficient allocation of physical resources on a global scale. By creating a more liquid and transparent market for real-world assets, we can potentially reduce inefficiencies, overproduction, and waste in global supply chains.

For instance, consider the potential in the agricultural sector:

- Tokenized Crop Futures: Farmers could tokenize their future crop yields, allowing for more efficient pre-selling and reducing the risk of overproduction. There are some platforms like Dimitra that make the first step towards this.

- Equipment Sharing: Expensive agricultural equipment could be tokenized and shared among multiple farms, optimizing usage and reducing idle time.

- Land Utilization: Underutilized agricultural land could be more easily identified and put to productive use through tokenized fractional ownership models.

Moreover, the potential for RWA tokenization to contribute to sustainability extends to environmental conservation efforts as well:

- Tokenized Carbon Credits: Making carbon credit markets more accessible and transparent through tokenization.

- Conservation Area Tokens: Allowing individuals to invest in and benefit from the preservation of natural habitats. FUND THE PLANET and other conservation firms are already utilizing real world assets tokenization to revolutionize how we carry out conservation efforts.

- Renewable Energy Investment: Facilitating fractional ownership in renewable energy projects, democratizing green energy investment.

- Energy-Efficient Smart Contracts: Smart contracts can be designed to optimize energy consumption by incorporating energy-efficient algorithms and protocols.

DualMint EcoWash Token is committed to sustainable practices, leveraging green blockchain technology to minimize environmental impact.

As we navigate the challenges of climate change and resource scarcity, tokenization of real world assets emerges as a powerful tool for reimagining our relationship with the physical world, potentially driving us toward a more sustainable and efficiently managed global ecosystem.

Tokenization as an Engine for Economic Development

The transformative potential of RWA tokenization extends beyond individual assets and into the realm of broader economic development. This technology could become a powerful engine for growth, particularly for small communities and developing economies.

One of the most exciting prospects of RWA tokenization is its ability to allow small communities to leverage their local assets on a global scale. Consider a small town with a unique natural resource, historical landmark, or thriving local industry. Traditionally, capitalizing on these assets might be limited by lack of exposure or access to global investment. It could change this dynamic dramatically:

- Local Asset Tokenization: Communities could tokenize local assets, from natural resources to infrastructure, allowing for global investment while maintaining local control.

- Tourism Tokens: Historical sites or natural attractions could be partially tokenized, allowing global investors to benefit from tourism revenue while providing funds for preservation and development.

- Local Business Expansion: Small businesses could tokenize future revenue streams, accessing global capital for expansion without traditional lending constraints.

This global-local connection facilitated by RWA tokenization could be particularly powerful for revitalizing struggling economies. It provides a mechanism for injecting capital into areas that traditional finance often overlooks, potentially spurring economic growth and job creation.

When we look at the markets showing the most interest in tokenization of real world assets, we see a diverse landscape that reflects its broad potential:

- Emerging Markets: as mentioned earlier, countries with developing economies show significant interest in RWA tokenization. It represents an opportunity to attract global capital, bypassing some of the limitations of traditional financial systems. Tokenization could allow these markets to 'leapfrog' certain stages of financial infrastructure development.

- Developed Markets: In more established economies, the focus is often on increasing liquidity in traditionally illiquid assets. Real estate is a prime example, with several projects in countries like the US, UK, and Singapore exploring tokenized property investments.

- Industries with High-Value, Indivisible Assets: Sectors like real estate, infrastructure, and fine art are at the forefront of RWA tokenization. These industries deal with assets typically high in value but difficult to divide or trade partially, making them ideal candidates for tokenization.

- Commodity Markets: There's growing interest in tokenizing commodities like precious metals, oil, and agricultural products. This could lead to more efficient trading and potentially reduce price volatility.

- Intellectual Property Markets: The entertainment and technology sectors are exploring tokenization as a means of monetizing and trading intellectual property rights more efficiently.

As RWA tokenization continues to evolve, we're likely to see its adoption spread across various sectors and geographies. The key to its success will lie in creating robust legal frameworks, ensuring technological reliability, and building trust among investors and asset owners.

The promise of real world assets tokenization as an engine for economic development is significant. By unlocking the value of previously illiquid assets and connecting local opportunities with global capital, it can reshape economic landscapes, foster more inclusive growth, and create new pathways for community and national development.