Introduction

We've written extensively about stablecoin crypto in molecula.io blog, covering their basics, safety and stability, and yield generation possibilities. We also noticed a recurring theme in Reddit and other socials, like: "How do stablecoins compare to Bitcoin?" It's clear that this comparison really piques your interest.

So, let's dive into the Bitcoin vs stablecoin debate.

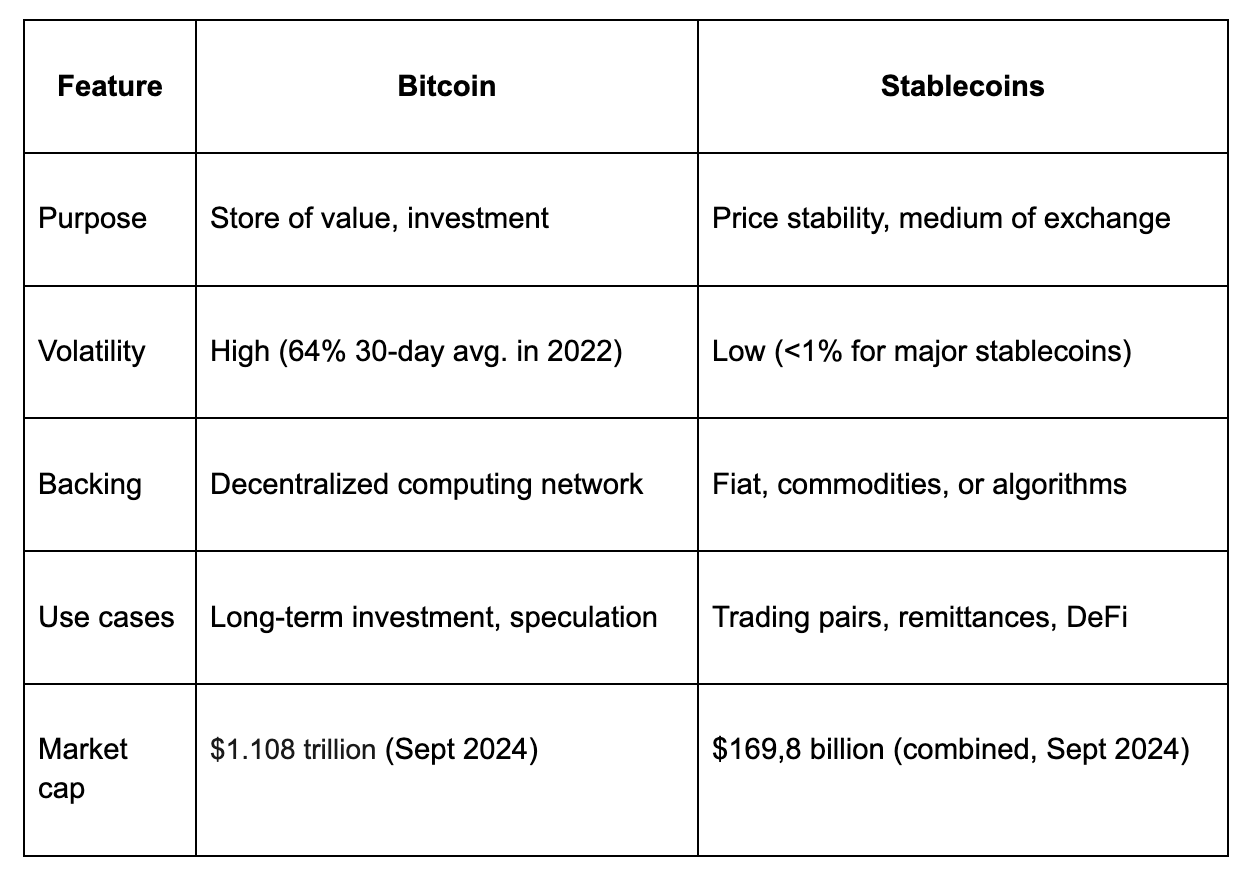

While both are cryptocurrencies, their roles in the digital finance ecosystem couldn't be more different. Bitcoin, with its over $1 trillion market cap, is the poster child of crypto volatility and speculation. Stablecoins, including crypto euro stablecoins, on the other hand, quietly processed $1.3 trillion in transactions by September 2024 and market cap $170.8 billion by Sept 10th `24, approaching Bitcoin's $1.44 trillion volume.

This article cuts through the noise, giving you the clear-cut between stablecoin and bitcoin you've been asking for. We'll explore the intricacies of bitcoin stablecoin relationships and answer the burning question: in the bitcoin vs stablecoin showdown, which one comes out on top?

Bitcoin is NOT a Stablecoin

Bitcoin is NOT a stablecoin. Period. This table can help you understand their fundamental differences in the bitcoin stablecoin comparison:

Bitcoin's volatility, while often seen as a drawback, can present significant opportunities. In 2023, Bitcoin's annualized volatility averaged 54%, compared to 2.63% for the S&P 500. This volatility contributed to Bitcoin outperforming traditional assets, with a 161% return in 2023 versus 25% for the S&P 500.

Stablecoins, conversely, were created to address the need for stability in the crypto world. During the March 2020 market crash, Bitcoin's price plummeted 37% in two days, while USDT, one of the safest crypto stablecoins, deviated by only 2% from its peg. This stark contrast in behavior during market turbulence underscores their different roles and design philosophies in the stablecoin vs crypto debate.

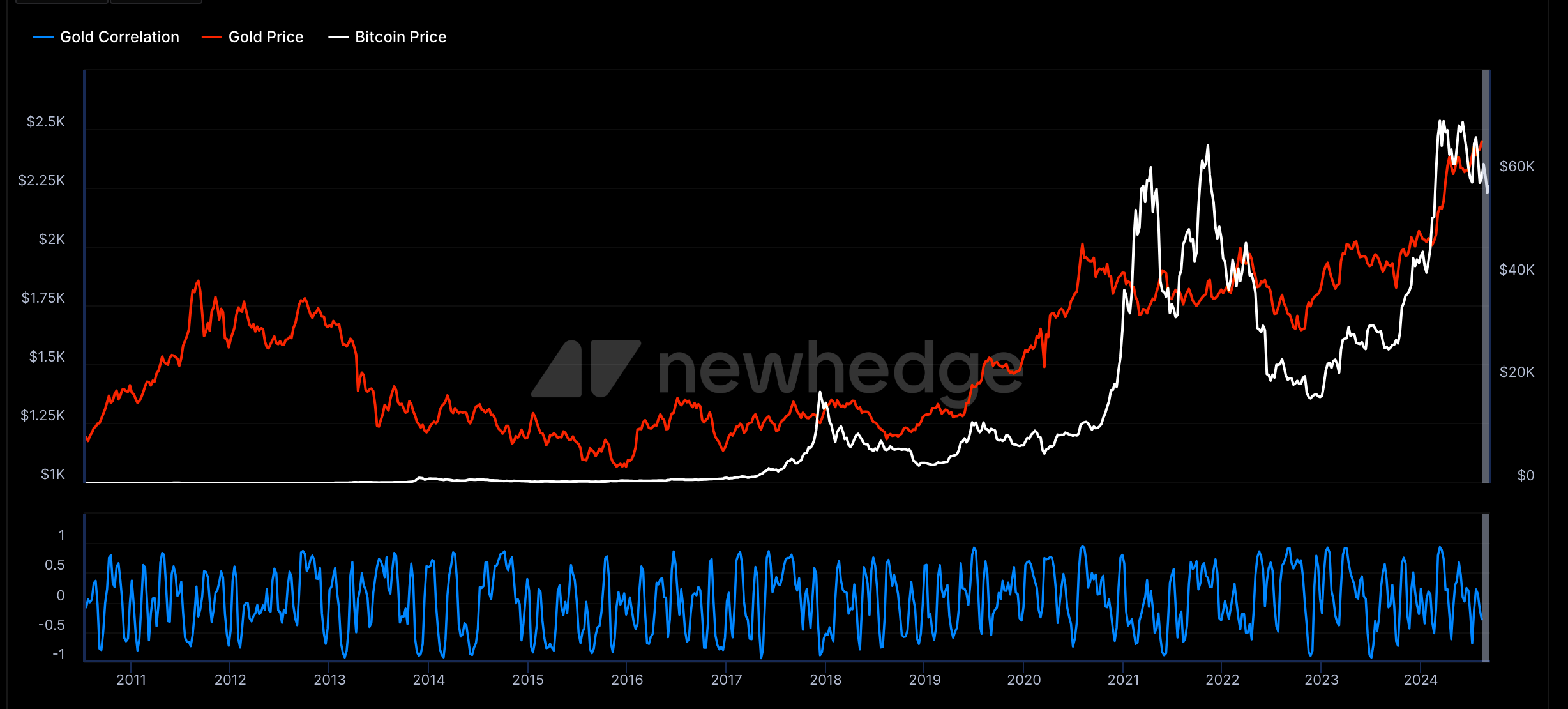

The backing mechanisms further differentiate these assets. Bitcoin derives value from its network effect and perceived scarcity, while stablecoins use various methods to maintain stability, including fiat reserves, crypto collateralization, and algorithmic mechanisms.

Understanding these differences is crucial for effective crypto portfolio management. During the 2022 crypto market downturn, as Bitcoin's price fell by over 60%, the total stablecoin crypto market share increased 13.8% to 16.3%. This divergence highlights how these assets respond differently to market conditions, offering savvy investors opportunities for strategic asset allocation and risk management in both bull and bear markets.

“Digital currencies like Bitcoin and Ethereum are tremendously volatile, which makes pricing things in their terms very difficult. Stablecoins avoid this issue by locking their prices to a known reserve currency.“

Anthony Citrano, founder of Acquicent

Anthony Citrano, founder of AcquicentWhy People Mix One with Another: Unraveling the Crypto Confusion

The Illusion of Similarity

Both Bitcoin and stablecoins utilize blockchain technology, creating a superficial similarity that often misleads less informed users. The Terra/LUNA collapse in May 2022 further exemplified this misunderstanding, as Bitcoin's price dropped 18% in a week despite having no direct relation to the failed algorithmic stablecoin project. This event highlighted the importance of understanding the stablecoin vs crypto distinctions, especially in market turbulence.

Media Portrayal and Public Understanding

Bitcoin dominates not only the crypto market, but also news headlines, often overshadowing stablecoin crypto discussions. From 2013 to 2019, the first cryptocurrency has remained the leader by the number of mentions in the media. Most used words were ‘Bitcoin’ and ‘Crypto’, according to this study. The cognitive bias that can explain the situation described in the paragraph is availability bias (or availability heuristic). Since Bitcoin is more often mentioned in the media than stablecoins, the public's understanding of the cryptocurrency market may become skewed, leading them to believe that Bitcoin is more dominant or significant than other assets, like stablecoins, simply because it’s more frequently discussed.

Cognitive Biases that can influence the perception of crypto assets

The "halo effect" might lead people to attribute Bitcoin's characteristics to other cryptocurrencies. While specific studies on this in crypto are limited, the halo effect is a well-established psychological phenomenon. The "recency bias" also plays a significant role in crypto perceptions. A study by the University of Cambridge in 2023 found that 72% of retail crypto investors made trading decisions based on price movements in the past week, often conflating short-term trends across different crypto assets.

The Stability Paradox

Bitcoin's whitepaper described it as a "peer-to-peer electronic cash system," implying stability. However, its volatility is well-documented. In contrast, major stablecoins like USDT and USDC aim to maintain a 1:1 peg with the US dollar.

The Intertwined Ecosystem

Bitcoin stablecoin relationships are closely linked in the crypto market. In Q1 2023, the BTC/USDT pair accounted for over 60% of Bitcoin's spot trading volume on centralized exchanges.

The Knowledge Gap

While Bitcoin has achieved widespread recognition, stablecoins remain less understood. A 2023 Cryptoassets Consumer Research revealed that 79% of crypto users had heard of Bitcoin, but their understanding of stablecoins is low—17% of adults correctly identified their definition. A lack of knowledge of stablecoins is the main reason people have not bought them. Two in five (39%) cited a lack of knowledge as a reason not to have purchased stablecoins.

Educate Yourself: Stablecoin Fundamentals

Bridging the knowledge gap in stablecoins is crucial for any serious crypto investor or user. Around 90% of central banks are exploring Central Bank Digital Currencies (CBDCs), and most don't want to be left behind by bitcoin and other cryptocurrencies. So, it is the ultimate moment to follow their steps!

You can start by checking Coinbase Learn. It easily explains the concepts of digital currencies and blockchains.

The Binance Academy educates crypto beginners, introducing them to key concepts and terms.

Coindesk provides analytics, crypto news, podcasts, research, and 101 articles.

Always check strong analytics, specifically if it’s brought to you by DeFi demystifiers like DeFi Rate.

And, last but not least, Molecula.io blog offers in-depth analysis of stablecoin mechanisms.

Molecula_io on X.com provides real-time updates on stablecoin developments.

When exploring these resources, focus on understanding the different types of stablecoins and their market shares. As of September 2024, fiat-backed stablecoins dominate the market with 86% share, followed by crypto-backed (11%) and algorithmic (3%) stablecoins. Each type has its unique risk profile, with algorithmic stablecoins experiencing the highest de-peg incidents (15 in 2023) compared to fiat-backed (2) and crypto-backed (5).

Online communities can provide valuable insights, but verify information carefully. A 2023 study by the Blockchain Transparency Institute found that 37% of crypto-related social media posts contained misleading or false information. Stick to reputable sources and cross-reference data points.

Remember, the stablecoin space evolves rapidly. Continuous learning is key to navigating this dynamic sector of the crypto market effectively.