Introduction

Crypto enthusiasts, brace yourselves. The tap-to-earn (T2E) craze is a mirage in the digital gold rush. Hamster Kombat, the game on everyone's lips, boasts:

- 300M+ users

- 100B HMSTR total supply

- <$0.01 per token value

While the global crypto gaming market eyes $65.7B by 2027, tap-to-earn models are bleeding value. For every dollar earned by users, app owners pocket hundreds in ad revenue and data monetization.

Is this the future of crypto adoption or a massive wealth transfer disguised as financial inclusion? Let's dissect this phenomenon and explore why (and, more importantly, how) your time might be better spent elsewhere in the crypto ecosystem.

Tap-to-Earn Crypto: The Rise and Economical Model

Tap-to-earn (T2E) games, while recently surging in popularity on Telegram, evolved from the play-to-earn (P2E) model that gained traction in 2017 with blockchain games like CryptoKitties or StepN at the beginning of 2022.

These early games combined gaming with investment, allowing players to earn tokens exchangeable for other cryptocurrencies.

As interest in P2E waned, T2E games emerged, with Notcoin leading the charge with an average drop value of 200-400$. Its success story is gathering over 40 million players before launching its NOT token and airdropping 80 billion tokens - catalyzing the T2E boom.

This sparked a rush of developers and investors into the space, but Notcoin remains the most lucrative. In contrast, the DOGS airdrop yielded just $10-$20 for Telegram verification and social tasks.

Catizen cloned Hamster's tokenomics and added a donation mechanism. As a result, users who donated achieved 3x–4x returns on their initial investments, while non-donors received less than $10 on average.

With the crypto gaming market projected to hit $65.7B by 2027, T2E's true colors emerge: monetizing user engagement, not fulfilling wealth promises. The real beneficiaries of this model are the app owners. By attracting a large user base, they can generate substantial ad revenue, collect valuable user data and create a captive audience for future products or token sales. In the case of Hamster Kombat, reports suggest that each advertising contract was worth over $100,000. The game featured ads from casinos, banks, and marketplaces.

T2E games are masterfully designed to attract and retain a massive audience by leveraging key psychological principles:

- Simplicity: The ease of playing makes it accessible to anyone with a smartphone.

- Instant gratification: Players see immediate results from their actions, reinforcing engagement.

- Social proof: As more people join, it creates a snowball effect of popularity.

- FOMO (Fear of Missing Out): The promise of crypto rewards taps into the fear of missing the next big thing in the crypto world.

The Hamster Kombat Reality Check

Hamster Kombat exemplifies the tap-to-earn phenomenon, amassing over 300 million users with promises of easy crypto wealth. Its 100 billion HMSTR supply, with 64.38% in initial circulation, quickly led to token values plummeting from $0.012 to $0.008684 over the last few hours after the launch, marking a total decline of 30%.

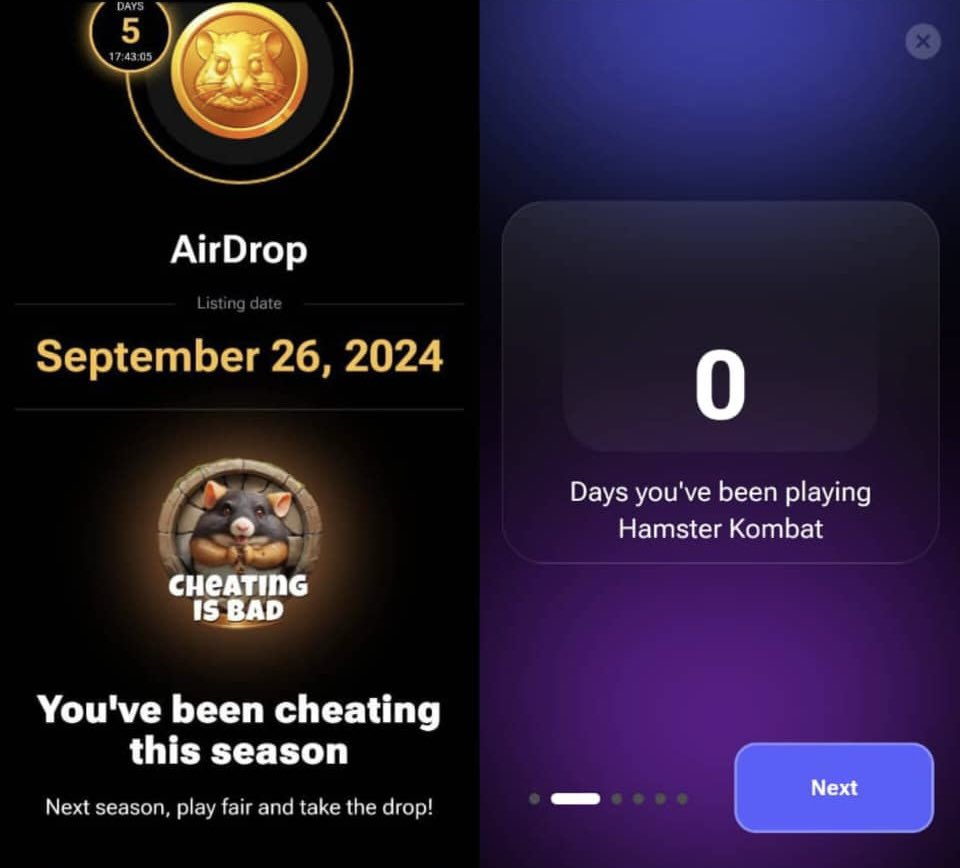

Users averaged payouts of 2,000-3,000 HMSTR, translating to a whopping $20-$40 for six months of engagement. Shockingly, 2.3 million users faced bans, often for using keygens sold by many bloggers. Some received ‘Cheating is Bad’ achievement.

This outcome starkly contrasts with the millions many players expected.

‘My wife promised me a new car if she made money from Hamster, but she only got $12. Guess I'll just keep walking!😂’ posted the user of Next100XGEMS Community.

The other user reported receiving 2,044 tokens, pegged to about $25 USD. This sum hardly justifies the time and energy invested over half a year. So, what are…

The Hidden Costs of Hamster Kombat

While Hamster Kombat might appear to be a free-to-play game, it comes with significant hidden costs:

- Time Sink: Users spend countless hours tapping their hamsters, which could be better spent exploring more promising crypto projects.

- Opportunity Loss: The energy devoted to Hamster Kombat diverts attention from learning reliable crypto strategies and participating in profitable DeFi protocols.

- Emotional Toll: The gamification of crypto earnings can lead to addictive behaviors and significant disappointment when rewards don't meet expectations.

- Data Exposure: Players often overlook the value of the personal data they're providing to the app developers, which could be exploited.

The Future of Hamster Kombat and Tap-to-Earn Games

The sustainability of the Hamster Kombat model is highly questionable. As more users realize the limited earning potential, engagement is likely to drop. Additionally, regulatory scrutiny may intensify as these games blur the lines between gaming and gambling.

Concrete data reveals the stark reality of Hamster Kombat's tokenomics:

- Total token supply: 100 billion HMSTR

- Initial circulating supply: 64.375 billion HMSTR (64.38% of total)

- Player rewards for Season 1: 60 billion HMSTR (60% of total)

- Team allocation: 8 billion HMSTR (8% of total)

These numbers show that while a significant portion of tokens was allocated to players, the massive supply and low individual token value resulted in minimal real-world returns for most participants

Reliable Ways to Earn in Crypto

Instead of relying on Hamster Kombat and similar tap-to-earn games, consider these more established crypto earning strategies:

- Stablecoin Staking: Platforms offering stablecoin staking provide a more reliable return compared to volatile cryptocurrencies. With annual percentage yields (APY) typically ranging from 5% to 12%, stablecoin staking offers a consistent and relatively low-risk way to grow your crypto holdings.

- DeFi Yield Farming: Decentralized Finance (DeFi) protocols offer various opportunities for earning yield on your crypto assets. By providing liquidity to decentralized exchanges or lending platforms, you can earn trading fees and additional token rewards.

- Tokenized Real-World Assets (RWAs): Some platforms offer tokenized versions of real-world assets like real estate or commodities. These often provide stable yields backed by tangible assets, bridging traditional finance with crypto innovation. This can be an interesting option for those looking to diversify their crypto portfolio with more traditional asset-backed investments.

To put these alternatives into perspective, let's compare potential returns:

- Hamster Kombat: Average user earned $20-$40 over 6 months. Time spent: countless.

- Stablecoin Staking (at 8% APY): $1000 investment would yield $40 in 6 months. Time spent: 3 seconds to hit the button on the platform offering staking.

In the crypto world, if something sounds too good to be true, it probably is. By educating yourself about various crypto earning methods and approaching the space with realistic expectations, you're more likely to achieve long-term success in the crypto than by tapping a digital hamster endlessly.