Introduction

DeFi has revolutionized wealth generation, offering yields that outpace traditional finance since 2018. However, high returns often mask significant risks. In 2024, promises of 20% APY should raise red flags, as exemplified by the $40 billion Terra/LUNA crash in 2022.

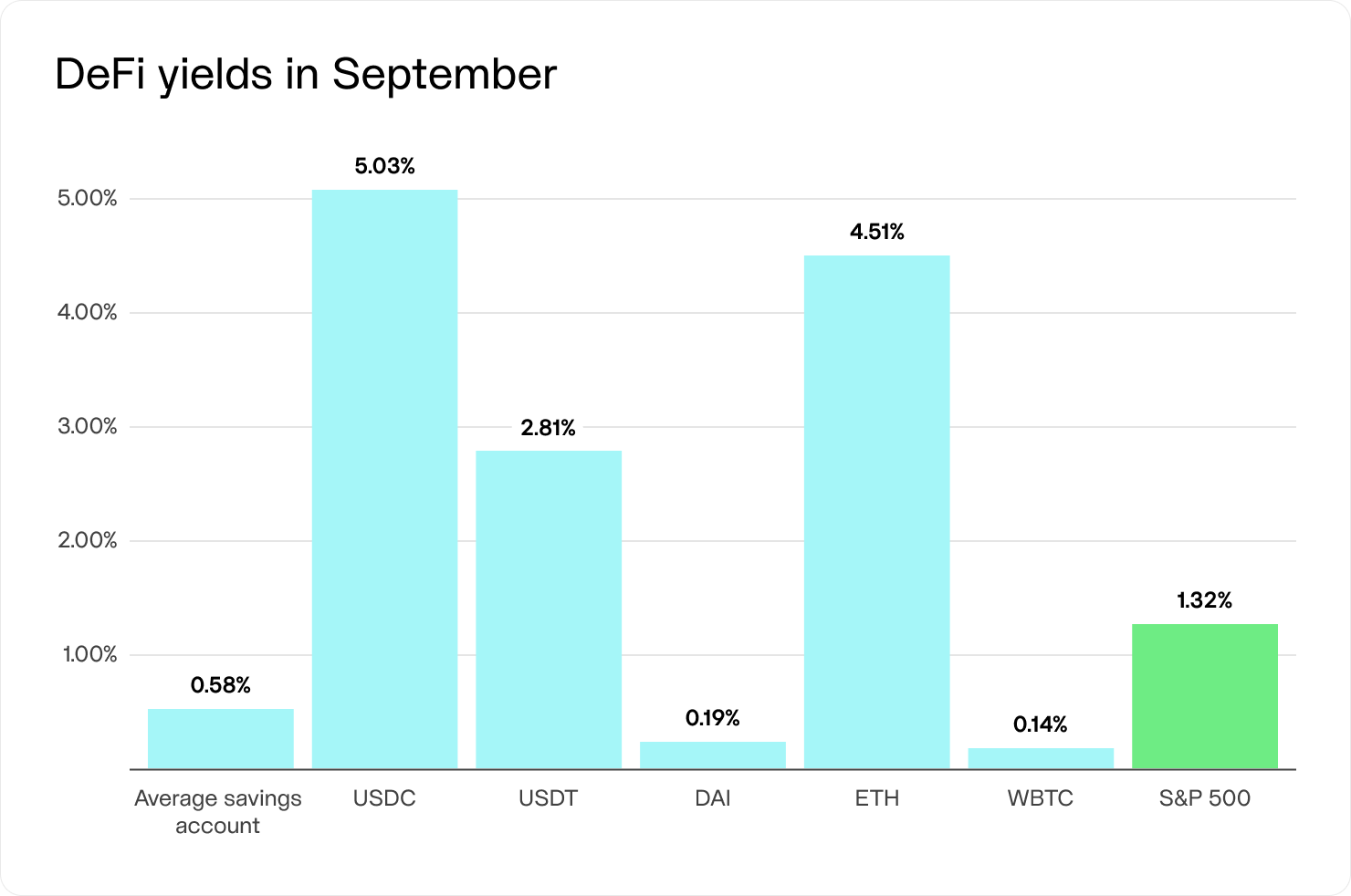

Reality check: The best DeFi yield in September 2024 is 5.03%, surpassing the S&P 500's 1.32% dividend yield and traditional savings' 0.58%. These DeFi earn rates demonstrate the potential for higher returns in the decentralized space.

Can we maximize returns while managing risks in DeFi earn? Is it safe and worthwhile? The short answer is YES, but it demands a strategic approach. This guide helps you navigate the DeFi landscape responsibly, focusing on how to earn DeFi interest effectively.

The Rise of the Crypto-Powered Digital Nomad

In 2023, the digital nomad population surged to over 35 million, while the DeFi market cap grew from $700 million in 2020 to over $46.61 billion in 2024.

WEB3 professionals are earning in crypto and stake crypto, as we mentioned in one of our previous blog posts. They're going even further: utilizing DeFi offering up to 8% APY on stablecoins, significantly outperforming traditional banks. By leveraging DeFi high-yield savings accounts, these nomads are building location-independent financial ecosystems that work continuously.

This shift represents more than a change in currency usage; it's a lifestyle revolution where digital assets and DeFi strategies form the backbone of financial management for millions of people.

The Appeal of DeFi: Reinventing Finance

From $700 million in 2020 to $50 billion in 2024, this market hums with activity, processing over 2 million daily transactions on Ethereum alone.

Innovators are playing financial Lego, combining protocols to create revolutionary products:

- Yearn Finance: catapulted from zero to $1 billion TVL in mere months

- Compound: grew from $100 million to $10 billion TVL in just one year

- Uniswap: exploded from $20 million to over $8 billion TVL in less than a year, revolutionizing decentralized trading

Smart contracts have automated the financial world: Aave has orchestrated $20 billion in loans without a single banker in sight. Users are flocking to this paradigm, with unique DeFi wallets surging 1,300% since 2020, now exceeding 5 million.

In this digital gold rush, particularly during the DeFi boom of 2020-2021, yield farmers on Curve Finance have struck rich veins, earning up to 20% APY on stablecoin deposits. Uniswap V3 liquidity providers have seen their funds swell by over 40% annually in popular pools.

At the same time, DeFi hacks siphoned off $1.3 billion in 2023, a stark reminder of the need for vigilance. Despite this, users continue to dive in, with adoption swelling 300% year-over-year.

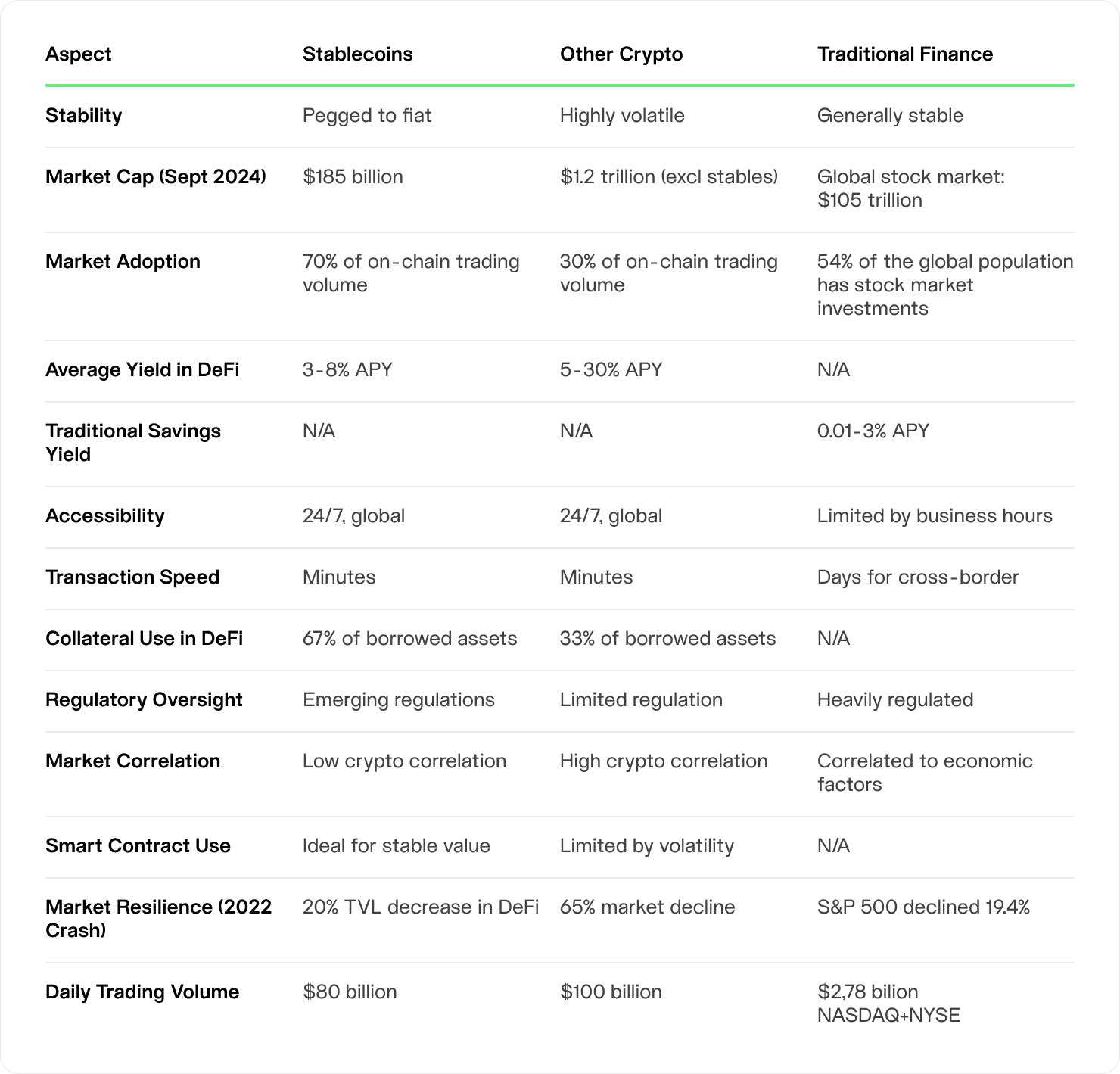

Stablecoins: Anchors in the Volatile DeFi Seas

With a $185 billion market cap and dominating 70% of on-chain trading volume, stablecoins become the bedrock of DeFi operations. Let's compare these financial anchors to other assets:

DeFi savings accounts with stablecoins provide a stable and profitable alternative to traditional savings, offering 3-8% APY in DeFi earn, while reducing exposure to crypto volatility. This appeals to both Web3 users and cautious investors. So, how can you maximize your yields?

Tailoring DeFi Strategies for Unique Case

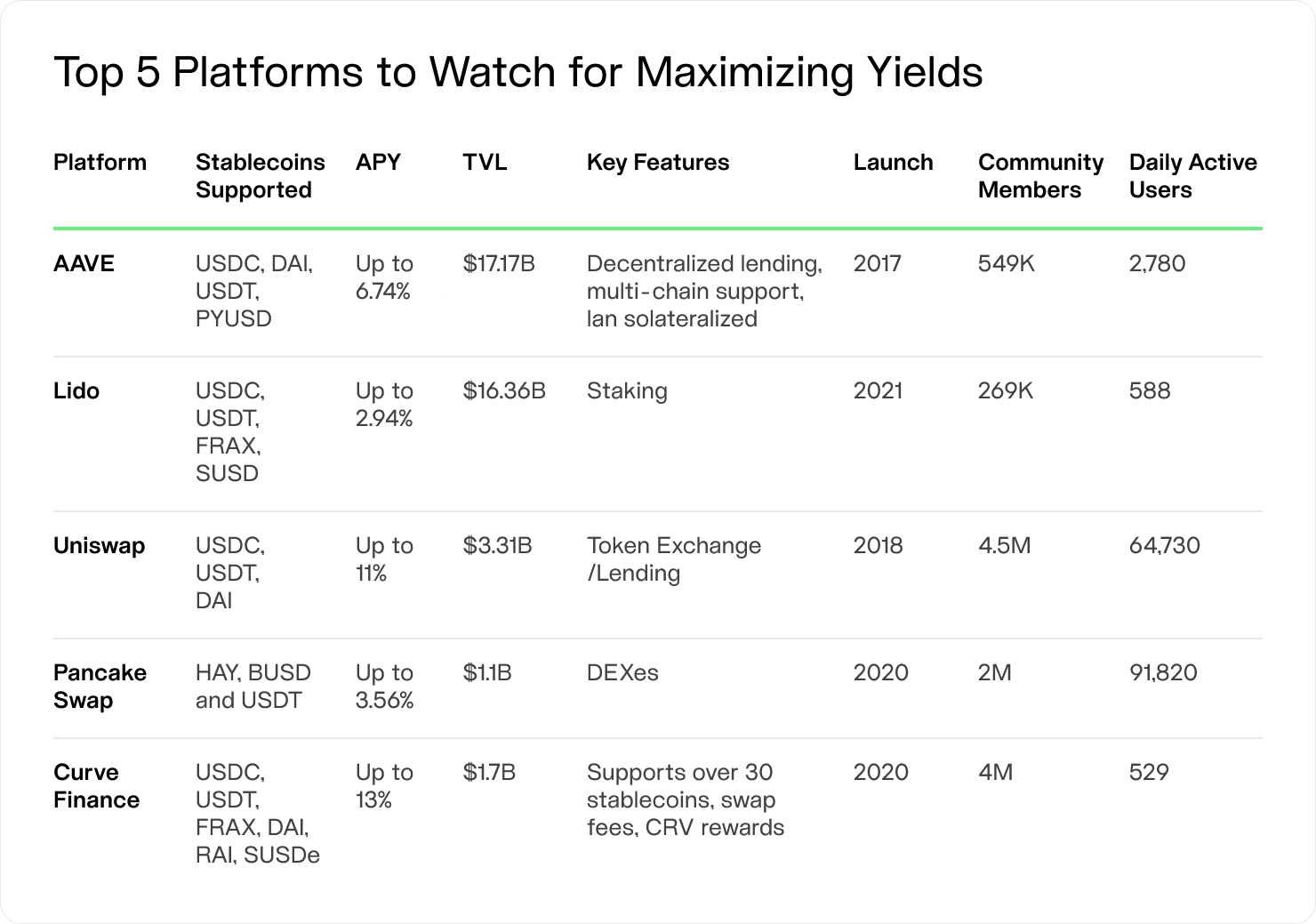

Creating a DeFi earn strategy that suits a location-independent lifestyle requires balancing short-term liquidity with long-term growth. DeFi savings accounts offer a new paradigm for earning interest on crypto assets. One of the popular approaches here is to manage liquidity through a "barbell strategy," placing 50-60% in high-yield savings accounts and the rest in longer-term opportunities. For example, 5,000 USDT in Aave (3.08% APY) for easy access, while staking 4,000 USDT in Aave V2 (6,74% APY) for higher yields.

Selecting the best DeFi wallet to earn interest is crucial for maximizing your returns. Mobile DeFi management is essential, with multi-chain wallets like MetaMask or Trust Wallet for access and hardware wallets like Ledger for added security. We dived into the topic in an article on the best usdt wallet.

For cross-border earnings, some use non-KYC DeFi protocols like Uniswap or dYdX, while tools like Koinly simplify tax reporting.

New strategies of evolving DeFi

Real World Asset (RWA) Tokenization:

Protocols like Centrifuge offer yields of 6-9% APY on tokenized real-world assets, providing diversification beyond crypto.

Liquid Staking:

Platforms like Lido allow users to stake assets while maintaining liquidity, currently offering around 3% APY on ETH.

Options and Derivatives:

Protocols like Opyn and dYdX enable advanced trading strategies, potentially boosting returns for experienced users.

Governance Participation:

Active involvement in protocol governance can lead to additional token rewards and influence over the platforms users rely on.

Flash Loans:

Advanced users leverage flash loans for arbitrage opportunities, executing complex transactions within a single block.

By combining these tools, even conservative users build a flexible, location-independent DeFi portfolio. Still, none of the information above is a financial advice. It is entirely up to you how to distribute assets and what methods to use for maximizing yields. Do Your Own Research - the main rule for every crypto owner.

The Future of DeFi for Digital Nomads

What future brings us?

The DeFi landscape is poised for significant growth and transformation. With a projected Compound Annual Growth Rate (CAGR) of 9.07% from 2024 to 2028, the DeFi market is expected to reach a staggering $37,040.00 million by 2028. This rapid evolution is reshaping various financial services, often surpassing traditional systems in efficiency and innovation.

Key future trends

Institutional DeFi: Projected to reach $1 trillion by 2025, institutional adoption is set to bring unprecedented stability and liquidity to the DeFi ecosystem.

AI Integration: The fusion of AI and DeFi is optimizing risk parameters and personalizing strategies. AI-driven protocols have shown a 30% improvement in prediction accuracy for yield farming strategies. By 2025, it's estimated that 40% of DeFi platforms will incorporate some form of AI for risk management and strategy optimization.

Regulatory Clarity: The EU's Markets in Crypto-Assets (MiCA) regulation, set to be fully implemented in 2024, may lead to compliant DeFi savings accounts. This regulatory framework is expected to bring 67% of crypto assets under regulatory oversight, potentially legitimizing DeFi in the eyes of traditional investors.

Cross-chain Interoperability: Projects focusing on seamless asset flow between blockchains are gaining traction. The total value locked (TVL) in cross-chain bridges has grown by 89% year-over-year, reaching $30 billion in 2024. This interoperability is expected to reduce friction and fees, with some estimates suggesting a 60% reduction in cross-chain transaction costs by 2026.

Decentralized Identities (DIDs): DID solutions are simplifying compliance while maintaining privacy. Adoption of DIDs in DeFi is projected to grow by 125% annually, with an estimated 250 million DeFi users expected to have a DID by 2027. The industry's response to these challenges will shape its future.

While DeFi is becoming more accessible and integrated with traditional finance, challenges remain. Security breaches in DeFi decreased by 35% in 2023 compared to 2022, but still accounted for $435 million in losses. Scalability issues persist, with Ethereum, the primary DeFi blockchain, processing only 15 transactions per second compared to Visa's 65,000. Regulatory compliance remains a moving target, as evidenced by a June 2023 assessment by the Financial Action Task Force (FATF), which found that 75% of assessed jurisdictions were either partially or not at all compliant with its requirements. This widespread lack of full compliance underscores the ongoing challenges in aligning DeFi with global regulatory standards.

The industry's response to these challenges will shape its future. Investments in DeFi security solutions have tripled since 2022, reaching $2 billion annually. Layer-2 scaling solutions are projected to increase Ethereum's transaction capacity by 100x by 2026. Regulatory-compliant DeFi platforms are expected to capture 45% of the total DeFi market share by 2028.

As DeFi continues to evolve, it promises to democratize finance on a global scale, with projections suggesting that by 2030, DeFi could provide financial services to over 1 billion currently unbanked individuals worldwide.